SPOILER ALERT!

Reliable Tips Concerning Your Vehicle Insurance Policy Coverage

Read the Full Posting written by-Sauer Mangum

"�Piece of mind' is the thought behind insurance. Sometimes it goes beyond that. The law may require a certain amount of coverage to avoid penalties. This is true of auto insurance. How can you make a wise decision regarding car insurance? Read the following article for some handy tips to do just that!

When considering insurance for a young driver, be sure to calculate the expected mileage per year. Many insurance providers will provide a discount for low mileage customers. Most likely, a high school age driver will qualify, even if they drive to school and work. Be sure to check with multiple agencies to compare rates.

When considering auto insurance for a young driver, be sure to consider your options as far as whether or not to include them on your policy or to get them their own policy. Depending on your current rates and history, it may or may not be beneficial for them to be included on your plan.

Another type of car insurance coverage in your policy, is medical coverage. This coverage takes care of your injuries and those injuries to other people in your car. Some states just make this a optional coverage in your insurance. If you live in a no-fault state, medical payments are replaced by personal injury protection.

Make the most of any discounts your insurance company offers. If you get a new security device, be sure to tell your insurance agent. You may very well be eligible for a discount. If you take a defensive driving course, be sure to let your agent know. It could save you money. If you are taking classes, find out if your car insurance company provides a student discount.

You shouldn't buy a vehicle unless you check the insurance rates on it first. You may find the car you really want has higher insurance rates for many different reasons. It may have a high rate of being stolen or wrecked, which can cause your insurance to be higher and you will be paying more for it.

Remove towing from your car insurance. Removing towing will save money. Proper maintenance of your car and common sense may ensure that you will not need to be towed. Accidents do happen, but they are rare. It usually comes out a little cheaper in the end to pay out of pocket.

One of the best things about auto insurance is that you can purchase this insurance from state to state. It is not state-limited like health insurance is. This means you can always browse around in other states for the best deals. A lot of drivers won't do this because they assume purchasing in-state coverage is the best way.

You should make sure you cancel your insurance if you want to switch your auto insurance company. This way you can be sure to leave on good terms with the company you are canceling with in case you change your mind and want to go back to them. This will also prevent you being canceled for non payment which can affect your credit.

Every state has specific legal requirements for minimum auto insurance. Property damage and bodily injury liability are the usual requirements. Ensuring that a driver's insurance meets these requirements is the driver's responsibility, not the insurance company's. Wise drivers research their local insurance laws and learn their legal minimums, to ensure that they get proper coverage.

Usually, you can find some of the best insurance deals on the web. This is because selling directly to customers cuts out costs like an agent. So the insurance companies get to keep a little more for themselves. This also will trickle down to you in the form of a small discount.

Whenever possible, avoid filing and submitting minor claims to your vehicle insurance provider. Unfortunately, increased reliance upon insurance services directly translates to significant increases in monthly rates. Consider filing claims only if you are unable to cover the cost of repairs, and if failure to have repairs creates an unsafe driving condition.

If you are torn between buying a sportier car or something more practical, then remember that both the value, as well as the style of your car, can affect your auto insurance rates significantly. Sportier cars and trucks can come with insurance rates that are two or three times higher than their more casual counterparts.

Do not allow your auto insurance policy to terminate for non-payment or terminate before you switch to a new insurer. If you do, this may cause your insurance rates to increase for quite some time.

One of the things that you can do in order to get cheaper auto insurance rates is to increase your voluntary excess. This extra is the amount of money that you will compensate in the event of a claim. By increasing this your insurance provider will then decrease your monthly premium.

A great tip to make sure your auto insurance stays as low as possible is to ensure your credit bureau report is as accurate as it can be. If this report is inaccurate, it could paint a bad picture of you, which will make your premiums higher than they could potentially be.

Check with your HR department at work to find out if there are any special discounts or deals you can get for auto insurance by declaring your employment there. Some employers will work with an insurance company to secure lower group rates. You may even get a larger discount if you have been with your employer for a longer period of time. If all else fails, you might even be able to bring up the idea for them to consider.

If you want to get cheap auto insurance rates as a brand new driver, one of the things that you can do is to take a pass plus. Some insurance companies can give up to 25% on discount if they know that you passed your test without any claims. This could greatly lower your insurance coverage.

As with any contractual agreement, read the fine print. There are different details provided in the fine print that you may want to be aware of, as knowing what it says could be the difference between your accepting or denying the policy. You could discover that you really aren't getting the coverage that you think you are getting.

Getting http://andreyawilsimar.blogspot.com/2021/02/30-car-insurance-high-risk-pictures.html for your car ensures that if anything happens to it, it can be fixed. That may not work the same as with a human life, but similar to insurance for people, it is really important to your future. So, do yourself a favor and do your research and apply the above tips to your policy hunt.

"�Piece of mind' is the thought behind insurance. Sometimes it goes beyond that. The law may require a certain amount of coverage to avoid penalties. This is true of auto insurance. How can you make a wise decision regarding car insurance? Read the following article for some handy tips to do just that!

When considering insurance for a young driver, be sure to calculate the expected mileage per year. Many insurance providers will provide a discount for low mileage customers. Most likely, a high school age driver will qualify, even if they drive to school and work. Be sure to check with multiple agencies to compare rates.

When considering auto insurance for a young driver, be sure to consider your options as far as whether or not to include them on your policy or to get them their own policy. Depending on your current rates and history, it may or may not be beneficial for them to be included on your plan.

Another type of car insurance coverage in your policy, is medical coverage. This coverage takes care of your injuries and those injuries to other people in your car. Some states just make this a optional coverage in your insurance. If you live in a no-fault state, medical payments are replaced by personal injury protection.

Make the most of any discounts your insurance company offers. If you get a new security device, be sure to tell your insurance agent. You may very well be eligible for a discount. If you take a defensive driving course, be sure to let your agent know. It could save you money. If you are taking classes, find out if your car insurance company provides a student discount.

You shouldn't buy a vehicle unless you check the insurance rates on it first. You may find the car you really want has higher insurance rates for many different reasons. It may have a high rate of being stolen or wrecked, which can cause your insurance to be higher and you will be paying more for it.

Remove towing from your car insurance. Removing towing will save money. Proper maintenance of your car and common sense may ensure that you will not need to be towed. Accidents do happen, but they are rare. It usually comes out a little cheaper in the end to pay out of pocket.

One of the best things about auto insurance is that you can purchase this insurance from state to state. It is not state-limited like health insurance is. This means you can always browse around in other states for the best deals. A lot of drivers won't do this because they assume purchasing in-state coverage is the best way.

You should make sure you cancel your insurance if you want to switch your auto insurance company. This way you can be sure to leave on good terms with the company you are canceling with in case you change your mind and want to go back to them. This will also prevent you being canceled for non payment which can affect your credit.

Every state has specific legal requirements for minimum auto insurance. Property damage and bodily injury liability are the usual requirements. Ensuring that a driver's insurance meets these requirements is the driver's responsibility, not the insurance company's. Wise drivers research their local insurance laws and learn their legal minimums, to ensure that they get proper coverage.

Usually, you can find some of the best insurance deals on the web. This is because selling directly to customers cuts out costs like an agent. So the insurance companies get to keep a little more for themselves. This also will trickle down to you in the form of a small discount.

Whenever possible, avoid filing and submitting minor claims to your vehicle insurance provider. Unfortunately, increased reliance upon insurance services directly translates to significant increases in monthly rates. Consider filing claims only if you are unable to cover the cost of repairs, and if failure to have repairs creates an unsafe driving condition.

If you are torn between buying a sportier car or something more practical, then remember that both the value, as well as the style of your car, can affect your auto insurance rates significantly. Sportier cars and trucks can come with insurance rates that are two or three times higher than their more casual counterparts.

Do not allow your auto insurance policy to terminate for non-payment or terminate before you switch to a new insurer. If you do, this may cause your insurance rates to increase for quite some time.

One of the things that you can do in order to get cheaper auto insurance rates is to increase your voluntary excess. This extra is the amount of money that you will compensate in the event of a claim. By increasing this your insurance provider will then decrease your monthly premium.

A great tip to make sure your auto insurance stays as low as possible is to ensure your credit bureau report is as accurate as it can be. If this report is inaccurate, it could paint a bad picture of you, which will make your premiums higher than they could potentially be.

Check with your HR department at work to find out if there are any special discounts or deals you can get for auto insurance by declaring your employment there. Some employers will work with an insurance company to secure lower group rates. You may even get a larger discount if you have been with your employer for a longer period of time. If all else fails, you might even be able to bring up the idea for them to consider.

If you want to get cheap auto insurance rates as a brand new driver, one of the things that you can do is to take a pass plus. Some insurance companies can give up to 25% on discount if they know that you passed your test without any claims. This could greatly lower your insurance coverage.

As with any contractual agreement, read the fine print. There are different details provided in the fine print that you may want to be aware of, as knowing what it says could be the difference between your accepting or denying the policy. You could discover that you really aren't getting the coverage that you think you are getting.

Getting http://andreyawilsimar.blogspot.com/2021/02/30-car-insurance-high-risk-pictures.html for your car ensures that if anything happens to it, it can be fixed. That may not work the same as with a human life, but similar to insurance for people, it is really important to your future. So, do yourself a favor and do your research and apply the above tips to your policy hunt.

SPOILER ALERT!

Opening The Door For Big Financial Savings With Vehicle Insurance Coverage

Article written by-Vance Nicolaisen

Auto insurance is something drivers simply must have. With https://www.vanderlaw.com/understanding-basics-personal-injury-cases/ in place, finding the best plan at the most affordable cost can be accomplished. Read on for some tips on finding auto insurance that fits your needs and your budget.

Most people today are purchasing their auto insurance via the Internet, but you should remember not to be sucked in by a good-looking website. Having the best website in the business does not mean a company has the best insurance in the business. Compare the black and white, the details. Do not be fooled by fancy design features and bright colors.

The year and options on your vehicle will play a large roll in how much your insurance premium is. Having mouse click the following article with lots of safety features can save you some, but if you have it financed you will also have to pay more for full coverage.

You may be able to save a bundle on car insurance by taking advantage of various discounts offered by your insurance company. Lower risk drivers often receive lower rates, so if you are older, married or have a clean driving record, check with your insurer to see if they will give you a better deal.

There are many ways to save money on your auto insurance policies, and one of the best ways is to remove drivers from the policy if they are no longer driving. A lot of parents mistakenly leave their kids on their policies after they've gone off to school or have moved out. Don't forget to rework your policy once you lose a driver.

To lower the cost of your insurance, you should pay attention to the kind of car that you wish to buy. If you buy a brand new car, insurance will be very high. On the other hand, a used car should allow you to get a lower rate, especially if it is an old model.

If you are putting less than 20% down on your car, make sure to look into getting GAP car insurance. Should you have an accident while you are still in the first year or two of payments, you may end up owing the bank more money than you would receive in a claim.

Every year when your automotive insurance is up for renewal, shop around to check that the premium being paid is still market competitive. There are an abundance of internet facilities available where you can enter the vehicle details online and immediately receive insurance quotes from various companies. This will confirm or deny that your current premium is realistic.

Before choosing the auto insurance policy that you think is right for you, compare rates. Comparing rates has been made easy with so many online insurance companies. Many of these companies will compare rates for you. Go to a couple of these sites and get many quotes from each before making your decision.

When you are checking rates with different car insurance companies, make sure your information is consistent with every quote you get. This way you can be sure you are getting the best quotes possible with each company you get quotes from. Then, you can accurately choose the company with the best rates.

The cost of auto insurance for any specific car, will vary from company to company. One of the reasons for this is because each company determines premiums based in part, on their past experiences with that specific car. Certain companies may have significantly different histories dealing with a specific car. Even in cases where the experiences are similar, there are bound to be small differences. Because of this, there is a definite benefit to shopping around when looking for auto insurance.

Hybrid vehicles are really underrated in terms of insurance prices. So if you want to save money on insurance, you might want to look at purchasing some type of hybrid vehicle. Apart from the great tax savings, you will also stand out as a low-risk driver in a hybrid, and thus your insurance premiums will ultimately drop.

If you are looking to spend the minimum amount possible on auto insurance, you should research what your state's laws are on required coverage. Many auto insurance companies and brokers will try to convince you that you need certain types of coverage to get you to spend more when legally you do not. Being aware of precisely what is required will help you to shop for the most affordable plan.

You should review your auto insurance policy regularly to make sure it accurately reflects your situation and your vehicle. Doing this shortly before your policy is set to renew is a good idea. Note any discrepancies and review them with your insurance company to make sure that your premium reflects your situation accurately.

Purchasing a smaller vehicle is actually a great way to save on automobile insurance. Larger SUVs might have some great safety features, but if we're talking about all-around savings, the smaller your automobile, the less you're ultimately, going to pay for insurance.

If you finance your vehicle, your lender may have requirements governing the level of auto insurance you must maintain during the duration of the loan. Generally, the requirements relate to how high you can have your deductible. Check with your lender before signing a new policy to avoid any conflicts.

You can get less expensive car insurance rates by increasing your credit score. Did you know that they're allowed to check your credit? Insurance companies use credit scores as one of the factors in determining your rates, because studies have found a correlation between people with low credit scores and people who get into accidents. Maintain a good credit rating to keep your insurance premiums from being raised.

Protect yourself, your passengers, and your insurance premiums by opting for cars with added or enhanced safety features whenever possible. Front and side airbags, passive restraint systems, and a variety of other safety options make your chance of serious injury much less in the event of an accident, which then keeps medical costs to a minimum. This translates into big savings for drivers of vehicles with these options.

Your goal is affordable auto insurance, but what exactly does that mean? By carefully considering the various factors involved, such as the amount of coverage you need, as well as the amount you want your deductible set at, among other factors, you are well on your way to making this important decision.

Auto insurance is something drivers simply must have. With https://www.vanderlaw.com/understanding-basics-personal-injury-cases/ in place, finding the best plan at the most affordable cost can be accomplished. Read on for some tips on finding auto insurance that fits your needs and your budget.

Most people today are purchasing their auto insurance via the Internet, but you should remember not to be sucked in by a good-looking website. Having the best website in the business does not mean a company has the best insurance in the business. Compare the black and white, the details. Do not be fooled by fancy design features and bright colors.

The year and options on your vehicle will play a large roll in how much your insurance premium is. Having mouse click the following article with lots of safety features can save you some, but if you have it financed you will also have to pay more for full coverage.

You may be able to save a bundle on car insurance by taking advantage of various discounts offered by your insurance company. Lower risk drivers often receive lower rates, so if you are older, married or have a clean driving record, check with your insurer to see if they will give you a better deal.

There are many ways to save money on your auto insurance policies, and one of the best ways is to remove drivers from the policy if they are no longer driving. A lot of parents mistakenly leave their kids on their policies after they've gone off to school or have moved out. Don't forget to rework your policy once you lose a driver.

To lower the cost of your insurance, you should pay attention to the kind of car that you wish to buy. If you buy a brand new car, insurance will be very high. On the other hand, a used car should allow you to get a lower rate, especially if it is an old model.

If you are putting less than 20% down on your car, make sure to look into getting GAP car insurance. Should you have an accident while you are still in the first year or two of payments, you may end up owing the bank more money than you would receive in a claim.

Every year when your automotive insurance is up for renewal, shop around to check that the premium being paid is still market competitive. There are an abundance of internet facilities available where you can enter the vehicle details online and immediately receive insurance quotes from various companies. This will confirm or deny that your current premium is realistic.

Before choosing the auto insurance policy that you think is right for you, compare rates. Comparing rates has been made easy with so many online insurance companies. Many of these companies will compare rates for you. Go to a couple of these sites and get many quotes from each before making your decision.

When you are checking rates with different car insurance companies, make sure your information is consistent with every quote you get. This way you can be sure you are getting the best quotes possible with each company you get quotes from. Then, you can accurately choose the company with the best rates.

The cost of auto insurance for any specific car, will vary from company to company. One of the reasons for this is because each company determines premiums based in part, on their past experiences with that specific car. Certain companies may have significantly different histories dealing with a specific car. Even in cases where the experiences are similar, there are bound to be small differences. Because of this, there is a definite benefit to shopping around when looking for auto insurance.

Hybrid vehicles are really underrated in terms of insurance prices. So if you want to save money on insurance, you might want to look at purchasing some type of hybrid vehicle. Apart from the great tax savings, you will also stand out as a low-risk driver in a hybrid, and thus your insurance premiums will ultimately drop.

If you are looking to spend the minimum amount possible on auto insurance, you should research what your state's laws are on required coverage. Many auto insurance companies and brokers will try to convince you that you need certain types of coverage to get you to spend more when legally you do not. Being aware of precisely what is required will help you to shop for the most affordable plan.

You should review your auto insurance policy regularly to make sure it accurately reflects your situation and your vehicle. Doing this shortly before your policy is set to renew is a good idea. Note any discrepancies and review them with your insurance company to make sure that your premium reflects your situation accurately.

Purchasing a smaller vehicle is actually a great way to save on automobile insurance. Larger SUVs might have some great safety features, but if we're talking about all-around savings, the smaller your automobile, the less you're ultimately, going to pay for insurance.

If you finance your vehicle, your lender may have requirements governing the level of auto insurance you must maintain during the duration of the loan. Generally, the requirements relate to how high you can have your deductible. Check with your lender before signing a new policy to avoid any conflicts.

You can get less expensive car insurance rates by increasing your credit score. Did you know that they're allowed to check your credit? Insurance companies use credit scores as one of the factors in determining your rates, because studies have found a correlation between people with low credit scores and people who get into accidents. Maintain a good credit rating to keep your insurance premiums from being raised.

Protect yourself, your passengers, and your insurance premiums by opting for cars with added or enhanced safety features whenever possible. Front and side airbags, passive restraint systems, and a variety of other safety options make your chance of serious injury much less in the event of an accident, which then keeps medical costs to a minimum. This translates into big savings for drivers of vehicles with these options.

Your goal is affordable auto insurance, but what exactly does that mean? By carefully considering the various factors involved, such as the amount of coverage you need, as well as the amount you want your deductible set at, among other factors, you are well on your way to making this important decision.

SPOILER ALERT!

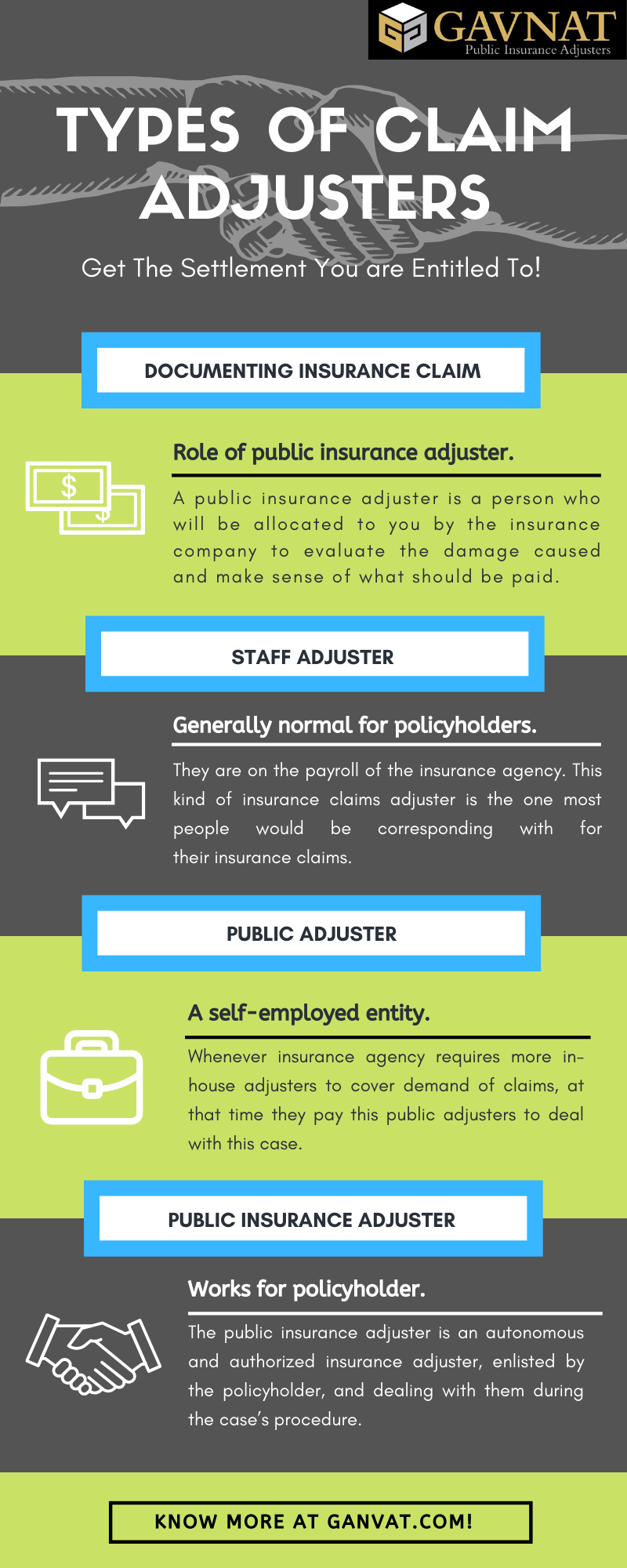

What Does A Public Insurer Does And Just How Can He Be Useful To You?

Written by-Tarp Kok

An insurance coverage sales agent can be quite a very useful expert to lots of insurance clients as well as belongs to the group that is called the general public insurer. Numerous are not knowledgeable about specifically what the job of the adjuster in fact entails. Basically, asserts insurance adjusters are there to ensure that the consumer's insurance demands are met. Insurance representatives call them insurers or brokers. Here's a closer consider what these individuals do in a day in the office:

- Checks on the validity - The entire process starts with an insurance claim being filed with the business that issues the policy. At this point, the insurance company will assess the case as well as confirm if it is a legitimate one. If please click the following internet page stands, the insurance holder will certainly be given a letter from the insurer to send to the various other party to compensate or obtain re-checked within a given amount of time. In turn, the various other party will return a letter stating if the insurance claim is valid or not.

- Determining the damages - After the firm receives the insurance claim, the Public Insurer will assess it and will certainly begin accumulating evidence. Sometimes, an insured person will require to find in as well as in fact see the damage to get a decision. When vinyl siding hail damage of the evidence has actually been accumulated by the representative, they will certainly request a short-lived estimate of the total quantity of cash required to settle the insurance claim. Now, the insured might hire the services of a public insurer or he may choose to file a claim with the Insurance coverage Division of the State or National Insurance Stats.

- Suggestions from insured - Once all of the evidence is in order, the general public Insurer will certainly take it to the following action and also will give suggestions to the guaranteed. Public Adjusters has the capability to tell the insured just how much the insurance must pay out. If the insurance adjuster really feels that the situation stands, he might recommend that the situation be checked out by an insurance adjuster who will be independent from the Insurance policy Department. At this point, if the situation needs further investigation, the general public Insurer will aid the adjuster by getting more information as well as data.

The insurers have the power to examine how the insurance provider has fixed previous cases. They can explore points like the number of denials and also the nature of those beings rejected. This is utilized by the insurance adjusters to determine whether a business's insurance plan are actually legitimate or not. The Public Insurance adjuster will also consider the kinds of losses that happened and will certainly use this info to establish how to manage future claims.

As part of the role of the public insurance coverage insurer, he/she has to additionally maintain a partnership with national as well as state supervisors of insurance provider. They should be able to make suggestions to these supervisors relating to any grievances filed against them. The general public Adjuster need to additionally keep documents on all communication that he/she receives from the business. By doing this, the Public Insurance adjuster can make certain that all communication is accurate. The records that he/she must preserve include the business's address, telephone number, fax number, and also insurance company's address. He/she needs to be really thorough in his/her records due to the fact that if there is ever a problem with a report, it will be very easy for him/her to fix it since it's in the public record.

The General Public Insurance adjuster is an essential part of the Insurance policy Department. Insurance coverage agents no more need to fret about the general public Insurer. If there ever ends up being a demand to examine an insurance coverage claim, insurance agents can call on the general public Adjuster to handle it. Public Insurers has lots of duties and also responsibilities, and also he/she is well worth the job.

In order to ensure that the Insurance policy Division is doing their task, there has been a demand for insurance policy agents to submit a Public Adjuster Form every year. This type is offered at their office or can conveniently be obtained on-line. To make sure that this does not take place again, insurance agents should adhere to every one of the regulations set forth in The Insurance Treatment Act.

An insurance coverage sales agent can be quite a very useful expert to lots of insurance clients as well as belongs to the group that is called the general public insurer. Numerous are not knowledgeable about specifically what the job of the adjuster in fact entails. Basically, asserts insurance adjusters are there to ensure that the consumer's insurance demands are met. Insurance representatives call them insurers or brokers. Here's a closer consider what these individuals do in a day in the office:

- Checks on the validity - The entire process starts with an insurance claim being filed with the business that issues the policy. At this point, the insurance company will assess the case as well as confirm if it is a legitimate one. If please click the following internet page stands, the insurance holder will certainly be given a letter from the insurer to send to the various other party to compensate or obtain re-checked within a given amount of time. In turn, the various other party will return a letter stating if the insurance claim is valid or not.

- Determining the damages - After the firm receives the insurance claim, the Public Insurer will assess it and will certainly begin accumulating evidence. Sometimes, an insured person will require to find in as well as in fact see the damage to get a decision. When vinyl siding hail damage of the evidence has actually been accumulated by the representative, they will certainly request a short-lived estimate of the total quantity of cash required to settle the insurance claim. Now, the insured might hire the services of a public insurer or he may choose to file a claim with the Insurance coverage Division of the State or National Insurance Stats.

- Suggestions from insured - Once all of the evidence is in order, the general public Insurer will certainly take it to the following action and also will give suggestions to the guaranteed. Public Adjusters has the capability to tell the insured just how much the insurance must pay out. If the insurance adjuster really feels that the situation stands, he might recommend that the situation be checked out by an insurance adjuster who will be independent from the Insurance policy Department. At this point, if the situation needs further investigation, the general public Insurer will aid the adjuster by getting more information as well as data.

The insurers have the power to examine how the insurance provider has fixed previous cases. They can explore points like the number of denials and also the nature of those beings rejected. This is utilized by the insurance adjusters to determine whether a business's insurance plan are actually legitimate or not. The Public Insurance adjuster will also consider the kinds of losses that happened and will certainly use this info to establish how to manage future claims.

As part of the role of the public insurance coverage insurer, he/she has to additionally maintain a partnership with national as well as state supervisors of insurance provider. They should be able to make suggestions to these supervisors relating to any grievances filed against them. The general public Adjuster need to additionally keep documents on all communication that he/she receives from the business. By doing this, the Public Insurance adjuster can make certain that all communication is accurate. The records that he/she must preserve include the business's address, telephone number, fax number, and also insurance company's address. He/she needs to be really thorough in his/her records due to the fact that if there is ever a problem with a report, it will be very easy for him/her to fix it since it's in the public record.

The General Public Insurance adjuster is an essential part of the Insurance policy Department. Insurance coverage agents no more need to fret about the general public Insurer. If there ever ends up being a demand to examine an insurance coverage claim, insurance agents can call on the general public Adjuster to handle it. Public Insurers has lots of duties and also responsibilities, and also he/she is well worth the job.

In order to ensure that the Insurance policy Division is doing their task, there has been a demand for insurance policy agents to submit a Public Adjuster Form every year. This type is offered at their office or can conveniently be obtained on-line. To make sure that this does not take place again, insurance agents should adhere to every one of the regulations set forth in The Insurance Treatment Act.

SPOILER ALERT!

Exactly how Does A Public Insurer Can Help You With Your Insurance claim?

Staff Writer-Boll Geertsen

If you are involved in an auto accident that was not your fault, you might be qualified to receive compensation from a Public Insurer. You can get settlement from the Insurance policy Department, even if you were not at fault. It is always suggested that you speak to an Insurance policy Representative before making any type of decisions worrying your claim. They can assist you via the insurance claims procedure and help you understand how the procedure functions.

Insurance Representatives are accredited by the state to function as Public Insurers. You, the insurance holder, are appointed by the insurer to serve as the general public Insurer. He or she works only for you as well as has definitely no connections to the insurance provider. Consequently, the insurance company will frequently appoint its best insurer to manage its cases.

Insurance coverage Representatives have to adhere to strict policies and guidelines. If you have questions concerning an insurance claim, you must route them to the cases division. You have to provide appropriate recognition and give duplicates of files such as your insurance policies, invoices, and so on. Additionally, you must remain tranquil and also cooperative as well as do not chew out the insurance adjuster. A great public insurer will certainly aid you with these things and maintain you informed.

Public Insurance adjusters will certainly review your case and also take action in a prompt manner. please click the next web page intend to resolve as fast as possible due to the fact that they do not wish to need to pay the excess costs connected with prolonged litigation. Insurance companies work with certified public insurers on a part-time or full time basis. Part time workers will certainly be responsible for claims, while permanent staff members will focus on functioning as numerous insurance claims as feasible. Most significantly, an excellent public insurer has accessibility to the ideal calls and will utilize this understanding to negotiate lower payment in your place.

If you are thinking about using the solutions of a professional public insurance adjuster, ask to examine referrals. See to it that they have a proven record of remarkable customer support. Inspect their customer checklist to guarantee that they have had a great negotiation rate in the past. You must also inspect referrals from various other clients who are pleased with their services.

Once you have actually chosen to collaborate with a reputable claims insurance adjuster, make certain to interact routinely with your insurer. Notify the insurance adjuster of any type of modifications that may happen during the process. Maintain all communication lines open with your insurance coverage company. Also, ensure that you feel comfy letting your adjuster know of any kind of problems that you have. The good public adjusters will certainly always listen to your issues and offer you thorough advice. If you are having difficulty communicating with your adjuster, it is necessary that you discover someone who wants and also able to communicate well with you.

Some insurer favor to hire real loss adjusters over independent brokers. This is since they feel more comfortable understanding that the broker is benefiting the insurer rather than a private insurance claim adjuster. Nevertheless, when an insurer employs an actual loss adjuster, they maintain the civil liberties to utilize him or her in any type of future negotiations with your insurance company. In https://drive.google.com/file/d/1tWbWOmAmOE-3IEYzTPfqpQMu7QT8dVBl/view , if you are managing an independent broker, he or she is not the very same individual who will be handling your insurance claim. This suggests that an independent broker can not provide you suggestions regarding your actual loss situation.

If you make a decision to collaborate with a professional public insurance adjuster, it is essential that you give them time to prepare your claim. The insurer will normally request a breakdown of your residential property losses prior to they begin dealing with your claim. They will likewise examine your insurance plan to see to it that the settlement offer is fair as well as reasonable. If a negotiation deal is not acceptable to you, the insurer will likely request more time to gather info and create a suitable deal.

If you are involved in an auto accident that was not your fault, you might be qualified to receive compensation from a Public Insurer. You can get settlement from the Insurance policy Department, even if you were not at fault. It is always suggested that you speak to an Insurance policy Representative before making any type of decisions worrying your claim. They can assist you via the insurance claims procedure and help you understand how the procedure functions.

Insurance Representatives are accredited by the state to function as Public Insurers. You, the insurance holder, are appointed by the insurer to serve as the general public Insurer. He or she works only for you as well as has definitely no connections to the insurance provider. Consequently, the insurance company will frequently appoint its best insurer to manage its cases.

Insurance coverage Representatives have to adhere to strict policies and guidelines. If you have questions concerning an insurance claim, you must route them to the cases division. You have to provide appropriate recognition and give duplicates of files such as your insurance policies, invoices, and so on. Additionally, you must remain tranquil and also cooperative as well as do not chew out the insurance adjuster. A great public insurer will certainly aid you with these things and maintain you informed.

Public Insurance adjusters will certainly review your case and also take action in a prompt manner. please click the next web page intend to resolve as fast as possible due to the fact that they do not wish to need to pay the excess costs connected with prolonged litigation. Insurance companies work with certified public insurers on a part-time or full time basis. Part time workers will certainly be responsible for claims, while permanent staff members will focus on functioning as numerous insurance claims as feasible. Most significantly, an excellent public insurer has accessibility to the ideal calls and will utilize this understanding to negotiate lower payment in your place.

If you are thinking about using the solutions of a professional public insurance adjuster, ask to examine referrals. See to it that they have a proven record of remarkable customer support. Inspect their customer checklist to guarantee that they have had a great negotiation rate in the past. You must also inspect referrals from various other clients who are pleased with their services.

Once you have actually chosen to collaborate with a reputable claims insurance adjuster, make certain to interact routinely with your insurer. Notify the insurance adjuster of any type of modifications that may happen during the process. Maintain all communication lines open with your insurance coverage company. Also, ensure that you feel comfy letting your adjuster know of any kind of problems that you have. The good public adjusters will certainly always listen to your issues and offer you thorough advice. If you are having difficulty communicating with your adjuster, it is necessary that you discover someone who wants and also able to communicate well with you.

Some insurer favor to hire real loss adjusters over independent brokers. This is since they feel more comfortable understanding that the broker is benefiting the insurer rather than a private insurance claim adjuster. Nevertheless, when an insurer employs an actual loss adjuster, they maintain the civil liberties to utilize him or her in any type of future negotiations with your insurance company. In https://drive.google.com/file/d/1tWbWOmAmOE-3IEYzTPfqpQMu7QT8dVBl/view , if you are managing an independent broker, he or she is not the very same individual who will be handling your insurance claim. This suggests that an independent broker can not provide you suggestions regarding your actual loss situation.

If you make a decision to collaborate with a professional public insurance adjuster, it is essential that you give them time to prepare your claim. The insurer will normally request a breakdown of your residential property losses prior to they begin dealing with your claim. They will likewise examine your insurance plan to see to it that the settlement offer is fair as well as reasonable. If a negotiation deal is not acceptable to you, the insurer will likely request more time to gather info and create a suitable deal.

SPOILER ALERT!

Exactly how Does A Public Insurance Adjuster Can Assist You With Your Claim?

Created by-Hendriksen Bengtson

If you are involved in an auto accident that was not your fault, you might be qualified to obtain settlement from a Public Insurance adjuster. You can acquire payment from the Insurance policy Division, even if you were not to blame. It is always recommended that you consult with an Insurance policy Agent prior to making any kind of choices worrying your case. They can help you with the claims procedure as well as aid you recognize exactly how the procedure functions.

Insurance Representatives are accredited by the state to work as Public Insurers. You, the insurance policy holder, are designated by the insurance company to work as the general public Insurance adjuster. She or he functions exclusively for you as well as has absolutely no ties to the insurance company. For that reason, the insurer will certainly frequently assign its ideal insurer to handle its claims.

Insurance Representatives need to adhere to rigorous rules and also laws. If you have concerns concerning a case, you must guide them to the claims division. You must supply proper recognition as well as provide copies of papers such as your insurance plan, receipts, etc. In addition, you must stay calm and cooperative as well as do not yell at the adjuster. An excellent public adjuster will certainly aid you with these things and maintain you notified.

Public Insurers will certainly review your claim and also act in a prompt way. Insurance Companies want to work out as quick as possible due to the fact that they do not wish to have to pay the excess costs connected with extensive lawsuits. Insurance companies hire qualified public insurers on a part-time or full time basis. Part-time employees will certainly be responsible for claims, while full time employees will certainly concentrate on working as many claims as feasible. Most notably, a great public insurer has access to the best get in touches with and will certainly utilize this expertise to negotiate reduced payment in your place.

If https://www.flickr.com/photos/jfpublicadjusters/ are taking into consideration utilizing the services of a specialist public insurer, ask to check recommendations. Make sure that they have a tried and tested performance history of exceptional customer service. Inspect their customer checklist to make sure that they have had a great settlement price in the past. You must additionally inspect referrals from other clients that are satisfied with their solutions.

Once you have actually made a decision to collaborate with a reliable claims insurance adjuster, be sure to interact regularly with your adjuster. Educate the adjuster of any modifications that may occur during the procedure. Maintain all interaction lines open with your insurance service provider. Likewise, https://www.propertycasualty360.com/2020/06/01/pc-legislative-round-up-june-2020/ that you really feel comfortable letting your insurance adjuster know of any kind of worries that you have. The great public insurance adjusters will always pay attention to your worries and give you comprehensive suggestions. If you are having difficulty interacting with your adjuster, it is necessary that you discover somebody who is willing and able to interact well with you.

Some insurance companies favor to work with actual loss insurers over independent brokers. This is due to the fact that they feel more comfy recognizing that the broker is working for the insurer instead of a specific claim insurer. Nonetheless, when an insurance company employs an actual loss insurer, they retain the rights to utilize him or her in any type of future ventures with your insurance provider. In many cases, if you are dealing with an independent broker, she or he is not the exact same individual that will be handling your claim. This suggests that an independent broker can not provide you guidance concerning your real loss circumstance.

If you choose to work with a professional public adjuster, it is necessary that you give them time to prepare your insurance claim. The adjuster will usually ask for a detailed list of your building losses before they begin working on your claim. They will certainly likewise evaluate your insurance plan to see to it that the negotiation deal is fair and reasonable. If a negotiation offer is not appropriate to you, the insurer will likely request for more time to gather information and also formulate an appropriate offer.

If you are involved in an auto accident that was not your fault, you might be qualified to obtain settlement from a Public Insurance adjuster. You can acquire payment from the Insurance policy Division, even if you were not to blame. It is always recommended that you consult with an Insurance policy Agent prior to making any kind of choices worrying your case. They can help you with the claims procedure as well as aid you recognize exactly how the procedure functions.

Insurance Representatives are accredited by the state to work as Public Insurers. You, the insurance policy holder, are designated by the insurance company to work as the general public Insurance adjuster. She or he functions exclusively for you as well as has absolutely no ties to the insurance company. For that reason, the insurer will certainly frequently assign its ideal insurer to handle its claims.

Insurance Representatives need to adhere to rigorous rules and also laws. If you have concerns concerning a case, you must guide them to the claims division. You must supply proper recognition as well as provide copies of papers such as your insurance plan, receipts, etc. In addition, you must stay calm and cooperative as well as do not yell at the adjuster. An excellent public adjuster will certainly aid you with these things and maintain you notified.

Public Insurers will certainly review your claim and also act in a prompt way. Insurance Companies want to work out as quick as possible due to the fact that they do not wish to have to pay the excess costs connected with extensive lawsuits. Insurance companies hire qualified public insurers on a part-time or full time basis. Part-time employees will certainly be responsible for claims, while full time employees will certainly concentrate on working as many claims as feasible. Most notably, a great public insurer has access to the best get in touches with and will certainly utilize this expertise to negotiate reduced payment in your place.

If https://www.flickr.com/photos/jfpublicadjusters/ are taking into consideration utilizing the services of a specialist public insurer, ask to check recommendations. Make sure that they have a tried and tested performance history of exceptional customer service. Inspect their customer checklist to make sure that they have had a great settlement price in the past. You must additionally inspect referrals from other clients that are satisfied with their solutions.

Once you have actually made a decision to collaborate with a reliable claims insurance adjuster, be sure to interact regularly with your adjuster. Educate the adjuster of any modifications that may occur during the procedure. Maintain all interaction lines open with your insurance service provider. Likewise, https://www.propertycasualty360.com/2020/06/01/pc-legislative-round-up-june-2020/ that you really feel comfortable letting your insurance adjuster know of any kind of worries that you have. The great public insurance adjusters will always pay attention to your worries and give you comprehensive suggestions. If you are having difficulty interacting with your adjuster, it is necessary that you discover somebody who is willing and able to interact well with you.

Some insurance companies favor to work with actual loss insurers over independent brokers. This is due to the fact that they feel more comfy recognizing that the broker is working for the insurer instead of a specific claim insurer. Nonetheless, when an insurance company employs an actual loss insurer, they retain the rights to utilize him or her in any type of future ventures with your insurance provider. In many cases, if you are dealing with an independent broker, she or he is not the exact same individual that will be handling your claim. This suggests that an independent broker can not provide you guidance concerning your real loss circumstance.

If you choose to work with a professional public adjuster, it is necessary that you give them time to prepare your insurance claim. The adjuster will usually ask for a detailed list of your building losses before they begin working on your claim. They will certainly likewise evaluate your insurance plan to see to it that the negotiation deal is fair and reasonable. If a negotiation offer is not appropriate to you, the insurer will likely request for more time to gather information and also formulate an appropriate offer.

SPOILER ALERT!

Public Adjuster - What Does a Public Insurer Does?

Written by-Hendriksen Bengtson

An Insurance Coverage Adjuster or Public Insurance adjuster is a qualified professional that provides insurance coverage cases processing solutions for an Insurance Company. They are in charge of all matters connected to insurance policy asserts processing, including: Insurance policy Representative Education And Learning as well as Training, preserving customer files, underwriting plans as well as revivals, suggesting customers on post-policy maintenance setups, settling claims, and also handling all case data and correspondence. The function they play is important to Insurer because they guarantee that all of the essential procedures and policies associated with insurance policy cases are complied with, are executed properly, and all parties associated with the cases procedure are totally informed of their rights and duties. Most significantly, they guarantee that each of the entailed celebrations is made up for their loss. Insurance coverage Adjusters need to have superb interaction skills, interpersonal skills, superb analytical skills, outstanding composing skills, considerable experience, and knowledge of the laws that apply to their location of proficiency. Several of the many areas they need to deal with include:

Insurance claims Insurance adjusters are usually confused with Cases Supervisors, which are usually thought of as the exact same work. In truth, however, the duties as well as duties of a claims insurance adjuster and also a manager do really different points. Cases Insurers usually give all of the info required for the client or insurance policy holder to acquire the insurance policy advantages they are entitled to with their insurance policy. Cases Insurance adjusters do not deal with the day to day insurance claims process, but rather record to the Insurance provider's Claims Division or to the customer's Manager. Also, asserts insurers are not paid by the customer straight, but rather pay the Insurance Company straight for their solutions.

The duty of a public insurer differs according to state legislation. In some states, insurance policy holders have the responsibility of speaking to and also speaking to public adjusters; nevertheless, in other states insurance holders are needed to file claims with the Insurance coverage Provider, not the Public Adjuster. In a lot of cases, the public insurer will follow up with the client, make an evaluation of the case and afterwards alert the insurance policy service provider of the case. Some state public adjusters also appoint staff to work with insurance claims at the customer's house or location of employment.

Each state has its very own policies concerning that can make a claim versus the residential property insurance provider. Policyholders ought to understand that if they choose not to adhere to the recommendations of the public insurer that they may be facing a public obligation claim. If they are identified to be "to blame" for a building insurance policy case, they might deal with fines, loss of present benefits, and even prison time. The most effective time to speak to a public insurer is well before a case is filed. There are https://www.hotfrog.com/company/1441897292005376 that an insurance holder can do to help prevent being the next victim.

Initially, insurance policy holders need to never ever sign any type of records or consent to spend for repair services or substitutes prior to talking to the insurer. Numerous insurer need a letter of consent from the homeowner for any sort of building insurance coverage claims. Insurance holders need to likewise be aware that in some states the legislations about when insurance claims can be filed have actually altered. It is an excellent suggestion for insurance holders to speak with their state insurance representatives. They can likewise check online for existing info about claims filing requirements. State insurance agents can be extremely useful in establishing that can make a residential or commercial property insurance case as well as who can not.

Insurance policy holders can also utilize the web to learn more about common blunders that occur with insurance agreements. They can learn more about the types of damages that might be covered by their insurance policy as well as about how to document all damages. Several insurance policies give added coverage for psychological and psychological suffering. Occasionally these fringe benefits will certainly be noted individually from the contract. Policyholders should review their insurance agreements meticulously and also constantly describe their insurance coverage documents for these certain information.

Insurance policy agents commonly have a financial motivation to work quickly. If they think that a client is overemphasizing or existing about physical damage, they can make fast insurance claims in order to work out the claim prior to the insurance adjuster has a possibility to investigate it additionally. Insurance companies are not needed to investigate all potential conflicts in between customers and adjusters. Oftentimes they will choose the alternative that supplies them one of the most money without performing any investigation whatsoever. Policyholders that have experienced this from their insurance representatives ought to make certain that they do not permit this method for their very own satisfaction.

If a public adjuster is picked to evaluate your insurance coverage agreement, you must make sure that you remain in full contract with all of the terms outlined within the paper. should i hire a public adjuster will certainly almost certainly need you to sign a master policy type that will certainly detail every one of your civil liberties and also responsibilities when making insurance claims. This kind is commonly offered to the insurance adjuster cost free and you ought to make certain to finish it in its totality. You need to also make certain to maintain all of your documents pertaining to your claim in a refuge, and also be careful to save a copy of the master policy form for your documents. When picking an insurance representative to work on your instance, you need to make certain that they have actually gotten all of the ideal professional license required for the area in which they are working.

An Insurance Coverage Adjuster or Public Insurance adjuster is a qualified professional that provides insurance coverage cases processing solutions for an Insurance Company. They are in charge of all matters connected to insurance policy asserts processing, including: Insurance policy Representative Education And Learning as well as Training, preserving customer files, underwriting plans as well as revivals, suggesting customers on post-policy maintenance setups, settling claims, and also handling all case data and correspondence. The function they play is important to Insurer because they guarantee that all of the essential procedures and policies associated with insurance policy cases are complied with, are executed properly, and all parties associated with the cases procedure are totally informed of their rights and duties. Most significantly, they guarantee that each of the entailed celebrations is made up for their loss. Insurance coverage Adjusters need to have superb interaction skills, interpersonal skills, superb analytical skills, outstanding composing skills, considerable experience, and knowledge of the laws that apply to their location of proficiency. Several of the many areas they need to deal with include:

Insurance claims Insurance adjusters are usually confused with Cases Supervisors, which are usually thought of as the exact same work. In truth, however, the duties as well as duties of a claims insurance adjuster and also a manager do really different points. Cases Insurers usually give all of the info required for the client or insurance policy holder to acquire the insurance policy advantages they are entitled to with their insurance policy. Cases Insurance adjusters do not deal with the day to day insurance claims process, but rather record to the Insurance provider's Claims Division or to the customer's Manager. Also, asserts insurers are not paid by the customer straight, but rather pay the Insurance Company straight for their solutions.

The duty of a public insurer differs according to state legislation. In some states, insurance policy holders have the responsibility of speaking to and also speaking to public adjusters; nevertheless, in other states insurance holders are needed to file claims with the Insurance coverage Provider, not the Public Adjuster. In a lot of cases, the public insurer will follow up with the client, make an evaluation of the case and afterwards alert the insurance policy service provider of the case. Some state public adjusters also appoint staff to work with insurance claims at the customer's house or location of employment.

Each state has its very own policies concerning that can make a claim versus the residential property insurance provider. Policyholders ought to understand that if they choose not to adhere to the recommendations of the public insurer that they may be facing a public obligation claim. If they are identified to be "to blame" for a building insurance policy case, they might deal with fines, loss of present benefits, and even prison time. The most effective time to speak to a public insurer is well before a case is filed. There are https://www.hotfrog.com/company/1441897292005376 that an insurance holder can do to help prevent being the next victim.

Initially, insurance policy holders need to never ever sign any type of records or consent to spend for repair services or substitutes prior to talking to the insurer. Numerous insurer need a letter of consent from the homeowner for any sort of building insurance coverage claims. Insurance holders need to likewise be aware that in some states the legislations about when insurance claims can be filed have actually altered. It is an excellent suggestion for insurance holders to speak with their state insurance representatives. They can likewise check online for existing info about claims filing requirements. State insurance agents can be extremely useful in establishing that can make a residential or commercial property insurance case as well as who can not.

Insurance policy holders can also utilize the web to learn more about common blunders that occur with insurance agreements. They can learn more about the types of damages that might be covered by their insurance policy as well as about how to document all damages. Several insurance policies give added coverage for psychological and psychological suffering. Occasionally these fringe benefits will certainly be noted individually from the contract. Policyholders should review their insurance agreements meticulously and also constantly describe their insurance coverage documents for these certain information.

Insurance policy agents commonly have a financial motivation to work quickly. If they think that a client is overemphasizing or existing about physical damage, they can make fast insurance claims in order to work out the claim prior to the insurance adjuster has a possibility to investigate it additionally. Insurance companies are not needed to investigate all potential conflicts in between customers and adjusters. Oftentimes they will choose the alternative that supplies them one of the most money without performing any investigation whatsoever. Policyholders that have experienced this from their insurance representatives ought to make certain that they do not permit this method for their very own satisfaction.

If a public adjuster is picked to evaluate your insurance coverage agreement, you must make sure that you remain in full contract with all of the terms outlined within the paper. should i hire a public adjuster will certainly almost certainly need you to sign a master policy type that will certainly detail every one of your civil liberties and also responsibilities when making insurance claims. This kind is commonly offered to the insurance adjuster cost free and you ought to make certain to finish it in its totality. You need to also make certain to maintain all of your documents pertaining to your claim in a refuge, and also be careful to save a copy of the master policy form for your documents. When picking an insurance representative to work on your instance, you need to make certain that they have actually gotten all of the ideal professional license required for the area in which they are working.

SPOILER ALERT!

What Does A Public Adjuster Does And Also Just How Can He Be Useful To You?

when to use a public adjuster written by-Vest Geertsen

An insurance policy sales agent can be rather a vital expert to many insurance coverage customers and also is part of the team that is called the public insurance adjuster. Many are not aware of precisely what the work of the insurer really entails. Put simply, asserts adjusters are there to make certain that the client's insurance policy needs are fulfilled. Insurance coverage representatives call them insurance adjusters or brokers. Below's a closer look at what these people perform in a day in the office:

- Look at the validity - The entire procedure starts with a claim being submitted with the business that issues the plan. Now, the insurer will certainly evaluate the claim as well as confirm if it is a legitimate one. If it stands, the insurance holder will certainly be provided a letter from the insurer to send out to the various other party to pay up or get re-checked within a given amount of time. Consequently, the other party will certainly return a letter saying if the insurance claim is valid or not.

- Measuring the damages - After the firm obtains the insurance claim, the Public Adjuster will examine it and also will certainly begin accumulating proof. Often, an insured person will require to come in as well as actually see the damage so as to get a determination. Once https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/p-c-insurers-moving-into-new-virtual-era-for-catastrophe-claims-handling-59265048 of the proof has been accumulated by the agent, they will certainly request a momentary price quote of the overall amount of cash required to settle the claim. At this point, the insured might work with the services of a public insurance adjuster or he might choose to sue with the Insurance policy Department of the State or National Insurance Data.

- Suggestions from insured - Once every one of the proof remains in order, the general public Insurer will certainly take it to the next action and will certainly offer recommendations to the guaranteed. Public Adjusters has the ability to tell the insured how much the insurance coverage needs to pay out. If the insurance adjuster feels that the instance is valid, he may suggest that the instance be checked out by an insurer who will be independent from the Insurance coverage Division. Now, if the case needs more examination, the general public Insurance adjuster will certainly aid the adjuster by getting further information and also information.

The insurers have the power to investigate exactly how the insurer has actually dealt with previous claims. They can check into points like the variety of rejections and also the nature of those beings rejected. This is utilized by the insurers to establish whether a business's insurance coverage are really legitimate or otherwise. The Public Insurance adjuster will certainly also consider the types of losses that happened and will certainly utilize this details to figure out just how to handle future insurance claims.

As part of the duty of the public insurance insurer, he/she needs to likewise maintain a relationship with nationwide and state supervisors of insurer. They have to be able to make suggestions to these directors regarding any complaints filed against them. The general public Adjuster have to additionally maintain records on all document that he/she receives from the companies. By doing this, the Public Insurer can make certain that all correspondence is exact. The records that he/she must keep consist of the firm's address, phone number, fax number, and also insurer's address. He/she should be really extensive in his/her documents because if there is ever a problem with a record, it will certainly be simple for him/her to remedy it since it remains in the general public document.

The Public Adjuster is an essential part of the Insurance Division. Insurance agents no longer require to worry about the Public Insurer. If there ever ends up being a requirement to evaluate an insurance case, insurance policy agents can call on the general public Adjuster to manage it. Public Insurance adjusters has numerous duties and obligations, and he/she is well worth the job.

In order to make certain that the Insurance coverage Department is doing their work, there has been a requirement for insurance representatives to fill in a Public Insurance adjuster Kind annually. This form is readily available at their workplace or can easily be obtained on the internet. To ensure that this does not take place once again, insurance agents should adhere to all of the guidelines set forth in The Insurance policy Procedure Act.

An insurance policy sales agent can be rather a vital expert to many insurance coverage customers and also is part of the team that is called the public insurance adjuster. Many are not aware of precisely what the work of the insurer really entails. Put simply, asserts adjusters are there to make certain that the client's insurance policy needs are fulfilled. Insurance coverage representatives call them insurance adjusters or brokers. Below's a closer look at what these people perform in a day in the office:

- Look at the validity - The entire procedure starts with a claim being submitted with the business that issues the plan. Now, the insurer will certainly evaluate the claim as well as confirm if it is a legitimate one. If it stands, the insurance holder will certainly be provided a letter from the insurer to send out to the various other party to pay up or get re-checked within a given amount of time. Consequently, the other party will certainly return a letter saying if the insurance claim is valid or not.

- Measuring the damages - After the firm obtains the insurance claim, the Public Adjuster will examine it and also will certainly begin accumulating proof. Often, an insured person will require to come in as well as actually see the damage so as to get a determination. Once https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/p-c-insurers-moving-into-new-virtual-era-for-catastrophe-claims-handling-59265048 of the proof has been accumulated by the agent, they will certainly request a momentary price quote of the overall amount of cash required to settle the claim. At this point, the insured might work with the services of a public insurance adjuster or he might choose to sue with the Insurance policy Department of the State or National Insurance Data.

- Suggestions from insured - Once every one of the proof remains in order, the general public Insurer will certainly take it to the next action and will certainly offer recommendations to the guaranteed. Public Adjusters has the ability to tell the insured how much the insurance coverage needs to pay out. If the insurance adjuster feels that the instance is valid, he may suggest that the instance be checked out by an insurer who will be independent from the Insurance coverage Division. Now, if the case needs more examination, the general public Insurance adjuster will certainly aid the adjuster by getting further information and also information.

The insurers have the power to investigate exactly how the insurer has actually dealt with previous claims. They can check into points like the variety of rejections and also the nature of those beings rejected. This is utilized by the insurers to establish whether a business's insurance coverage are really legitimate or otherwise. The Public Insurance adjuster will certainly also consider the types of losses that happened and will certainly utilize this details to figure out just how to handle future insurance claims.

As part of the duty of the public insurance insurer, he/she needs to likewise maintain a relationship with nationwide and state supervisors of insurer. They have to be able to make suggestions to these directors regarding any complaints filed against them. The general public Adjuster have to additionally maintain records on all document that he/she receives from the companies. By doing this, the Public Insurer can make certain that all correspondence is exact. The records that he/she must keep consist of the firm's address, phone number, fax number, and also insurer's address. He/she should be really extensive in his/her documents because if there is ever a problem with a record, it will certainly be simple for him/her to remedy it since it remains in the general public document.

The Public Adjuster is an essential part of the Insurance Division. Insurance agents no longer require to worry about the Public Insurer. If there ever ends up being a requirement to evaluate an insurance case, insurance policy agents can call on the general public Adjuster to manage it. Public Insurance adjusters has numerous duties and obligations, and he/she is well worth the job.

In order to make certain that the Insurance coverage Department is doing their work, there has been a requirement for insurance representatives to fill in a Public Insurance adjuster Kind annually. This form is readily available at their workplace or can easily be obtained on the internet. To ensure that this does not take place once again, insurance agents should adhere to all of the guidelines set forth in The Insurance policy Procedure Act.

SPOILER ALERT!

What Does A Public Insurance adjuster Does And Also How Can He Be Useful To You?

Authored by-Zamora Simpson

An insurance sales representative can be quite an important consultant to several insurance coverage clients as well as becomes part of the group that is called the public insurer. Numerous are not familiar with exactly what the job of the insurer actually involves. Simply put, claims insurers are there to make certain that the consumer's insurance needs are met. Insurance coverage representatives call them adjusters or brokers. Right here's a more detailed take a look at what these people do in a day in the office:

- Checks on the credibility - The entire process begins with an insurance claim being submitted with the company that issues the plan. Now, the insurance company will evaluate the case as well as validate if it is a legitimate one. If it stands, the insurance policy holder will certainly be given a letter from the insurance adjuster to send out to the various other event to pay up or obtain re-checked within a specific period of time. Subsequently, the various other celebration will send back a letter stating if the case is valid or not.

- Determining the damages - After the firm obtains the insurance claim, the Public Adjuster will certainly review it and also will begin gathering proof. Often, an insured individual will certainly need ahead in and also actually see the damage to get a decision. When every one of the proof has been accumulated by the representative, they will request a short-lived price quote of the overall amount of money needed to pay off the claim. At this moment, the insured may hire the services of a public adjuster or he might make a decision to sue with the Insurance policy Division of the State or National Insurance Statistics.

- Advice from insured - Once every one of the proof is in order, the Public Insurer will take it to the following step as well as will certainly give guidance to the guaranteed. Public Adjusters has the capacity to inform the insured just how much the insurance policy needs to pay out. If the adjuster really feels that the situation stands, he might suggest that the situation be investigated by an insurance adjuster that will be independent from the Insurance coverage Department. At this point, if the instance needs further examination, the general public Insurance adjuster will aid the adjuster by getting additional details and data.

The insurers have the power to check out exactly how the insurance company has actually fixed previous cases. They can check into things like the number of rejections as well as the nature of those beings rejected. This is made use of by the insurance adjusters to figure out whether a company's insurance coverage are actually valid or otherwise. please click the following website will also consider the sorts of losses that took place and also will certainly utilize this information to establish exactly how to handle future claims.

As part of the role of the public insurance coverage adjuster, he/she needs to likewise maintain a relationship with nationwide as well as state supervisors of insurer. They must be able to make suggestions to these supervisors concerning any kind of issues filed against them. The general public Adjuster have to additionally maintain documents on all communication that he/she gets from the business. By doing this, the Public Insurer can see to it that all correspondence is accurate. The documents that he/she must maintain consist of the firm's address, phone number, telephone number, and insurance provider's address. He/she should be very thorough in his/her documents because if there is ever before a trouble with a record, it will be easy for him/her to fix it considering that it's in the public document.

The General Public Insurance adjuster is an essential part of the Insurance Division. Insurance representatives no longer need to stress over the Public Insurance adjuster. If there ever comes to be a demand to review an insurance policy case, insurance representatives can call on the Public Adjuster to manage it. Public Adjusters has many duties and also obligations, as well as he/she is well worth the work.