SPOILER ALERT!

Comprehending The Claims Process

Article written by-Funch Yates

When an accident takes place, it's natural to really feel urged to look for compensation from your insurance policy service provider. However, submitting a claim can be complicated as well as tiresome, involving massive quantities of documentation.

Whether you're filing an auto, home or obligation case, the procedure follows similar standards and also is broken down into 4 phases. Understanding these phases can assist you submit your insurance case successfully.

As you deal with your insurance company to sue, they will certainly send you papers needing you to offer evidence of loss, including buck quantities. They may likewise request information from your physician or company. This is a common part of the cases process, as well as it is usually done to verify your insurance policy covers what you are claiming for.

Once Suggested Online site of loss is gotten, they will certainly validate it against your insurance plan as well as deductibles to ensure they are proper. They will certainly after that send you an explanation of advantages that will certainly information the solutions obtained, amount paid by insurance coverage as well as staying debt.

Insurance provider can make the cases process a lot easier if they maintain their clients and staff members delighted by keeping a clear and also regular experience. One method they can do this is by ensuring their employees have the ability to quickly answer any questions or issues you have. You can also consult your state insurance department to see if they have any kind of problems against a particular firm or agent.

When an insurance claim is refuted, it can trigger tremendous aggravation, confusion and also expenditure. It is very important to keep up to day on your insurance provider's adjudication and allure processes. This details must be readily available on their internet sites, as well as they ought to also give it in hard copy when you enroll in new protection with them.

When you obtain a notification of denial, ask for the certain reason in writing. This will permit you to compare it to your understanding of the insurance policy conditions.

Always document your follow-up calls and conferences with your insurance provider. This can aid you in future activities such as taking an appeal to a greater degree or filing a legal action. Tape the date, time and also name of the agent with whom you talk. This will conserve you valuable time when you require to reference those documents in the future. Also, it will enable you to track who has been communicating with you throughout this process.

When the insurance provider has actually verified your insurance claim, they will send out settlement to the healthcare provider for solutions rendered. This can take a few days to several weeks. Once the insurer issues a settlement, you will certainly obtain a Description of Advantages (EOB) statement that details just how much the carrier billed and just how much insurance policy covers. The company will certainly then expense individuals as well as companies for the rest, minus coinsurance.

If you have any problems with your case, make certain to document every communication with the insurer. Keeping a record of whatever that goes on with your case can assist accelerate the process.

It's likewise important to keep invoices for extra expenditures that you might be compensated for, particularly if your house was damaged in a storm or fire. Having a clear as well as documented claims procedure can additionally aid insurer enhance customer retention by offering a better experience. It can additionally help them identify areas of their procedure that could be enhanced.

Insurance companies take care of numerous insurance claims every day, so they have systems in place to track each action of the procedure for all the insurance policy holders. This allows them to keep your original case and also any kind of charms you may make arranged in such a way that is easy for them to manage. It's important for you to mirror their process by maintaining every one of your documentation in one location that is easy to gain access to and evaluation.

If you choose to submit an insurer charm, collect the proof that supports your instance. https://blogfreely.net/dwayne359terisa/the-role-of-technology-in-changing-insurance-coverage-representative-practices can include cops records, eyewitness info, pictures and also medical reports.

Bear in mind that your insurer is a for-profit company as well as their objective is to lessen the quantity they honor you or pay in a settlement. related resource site is because any kind of awards they make lower their revenue stream from the costs you pay. They may additionally see this as a factor to raise your future prices.

When an accident takes place, it's natural to really feel urged to look for compensation from your insurance policy service provider. However, submitting a claim can be complicated as well as tiresome, involving massive quantities of documentation.

Whether you're filing an auto, home or obligation case, the procedure follows similar standards and also is broken down into 4 phases. Understanding these phases can assist you submit your insurance case successfully.

1. You'll Receive a Notification of Claim

As you deal with your insurance company to sue, they will certainly send you papers needing you to offer evidence of loss, including buck quantities. They may likewise request information from your physician or company. This is a common part of the cases process, as well as it is usually done to verify your insurance policy covers what you are claiming for.

Once Suggested Online site of loss is gotten, they will certainly validate it against your insurance plan as well as deductibles to ensure they are proper. They will certainly after that send you an explanation of advantages that will certainly information the solutions obtained, amount paid by insurance coverage as well as staying debt.

Insurance provider can make the cases process a lot easier if they maintain their clients and staff members delighted by keeping a clear and also regular experience. One method they can do this is by ensuring their employees have the ability to quickly answer any questions or issues you have. You can also consult your state insurance department to see if they have any kind of problems against a particular firm or agent.

2. You'll Receive a Notification of Denial

When an insurance claim is refuted, it can trigger tremendous aggravation, confusion and also expenditure. It is very important to keep up to day on your insurance provider's adjudication and allure processes. This details must be readily available on their internet sites, as well as they ought to also give it in hard copy when you enroll in new protection with them.

When you obtain a notification of denial, ask for the certain reason in writing. This will permit you to compare it to your understanding of the insurance policy conditions.

Always document your follow-up calls and conferences with your insurance provider. This can aid you in future activities such as taking an appeal to a greater degree or filing a legal action. Tape the date, time and also name of the agent with whom you talk. This will conserve you valuable time when you require to reference those documents in the future. Also, it will enable you to track who has been communicating with you throughout this process.

3. You'll Obtain a Notice of Repayment

When the insurance provider has actually verified your insurance claim, they will send out settlement to the healthcare provider for solutions rendered. This can take a few days to several weeks. Once the insurer issues a settlement, you will certainly obtain a Description of Advantages (EOB) statement that details just how much the carrier billed and just how much insurance policy covers. The company will certainly then expense individuals as well as companies for the rest, minus coinsurance.

If you have any problems with your case, make certain to document every communication with the insurer. Keeping a record of whatever that goes on with your case can assist accelerate the process.

It's likewise important to keep invoices for extra expenditures that you might be compensated for, particularly if your house was damaged in a storm or fire. Having a clear as well as documented claims procedure can additionally aid insurer enhance customer retention by offering a better experience. It can additionally help them identify areas of their procedure that could be enhanced.

4. You'll Obtain a Notice of Last Negotiation

Insurance companies take care of numerous insurance claims every day, so they have systems in place to track each action of the procedure for all the insurance policy holders. This allows them to keep your original case and also any kind of charms you may make arranged in such a way that is easy for them to manage. It's important for you to mirror their process by maintaining every one of your documentation in one location that is easy to gain access to and evaluation.

If you choose to submit an insurer charm, collect the proof that supports your instance. https://blogfreely.net/dwayne359terisa/the-role-of-technology-in-changing-insurance-coverage-representative-practices can include cops records, eyewitness info, pictures and also medical reports.

Bear in mind that your insurer is a for-profit company as well as their objective is to lessen the quantity they honor you or pay in a settlement. related resource site is because any kind of awards they make lower their revenue stream from the costs you pay. They may additionally see this as a factor to raise your future prices.

SPOILER ALERT!

5 Secret Factors To Take Into Consideration When Assessing An Insurance Provider

Content create by-Lunding Klit

A few vital metrics are utilized to worth insurance companies, which take place to be usual to all financial companies. These include price to publication as well as return on equity.

Check out the service providers an agent advises to see which ones have solid ratings and also financial stability. You need to also check the provider's financial investment danger account and concentration in risky financial investments.

It's clear that customer service is an essential element of an insurance provider. A poor experience can trigger clients to quickly switch to rivals, while a positive communication can lead them to recommend your firm to friends and family.

Examining your customer care can aid you determine ways to enhance your processes. For Best Condo Insurance , you can measure the length of time it takes for a consumer to connect with an agent or the portion of telephone calls that go unanswered. You can also examine initial phone call resolution prices, which can aid you establish how well your team is able to solve troubles.

To provide great customer support, you need to understand what your clients want and also exactly how to fulfill those demands. renters insurance agents near me of the Consumer program can supply this details as well as assist you drive consumer contentment.

Financial toughness is a crucial element of any insurance provider. This is because it demonstrates how much money or properties the business carries hand to pay temporary financial obligations. It likewise helps capitalists comprehend exactly how dangerous it is to purchase that certain firm.

Regulators require a specific level of resources symmetrical to an insurance firm's riskiness. Capitalists, other points equivalent, prefer that more equity be preserved as well as less financial debt provided for a provided ranking degree however this need to stabilize with the requirement to guarantee an insurance provider can meet its insurance policy holder claims responsibilities.

Brokers/ representatives as well as insurance policy buyers commonly wish to see a high rating before offering insurance or reinsurance company. This is partly as a result of the understanding that higher rated business are much better managed, yet also because it can help them fulfill their very own internal due persistance requirements and also disclosures.

Whether the insurer is answering inquiries about plan benefits, processing a claim or handling a complaint, you would like to know that they listen and responsive. Take a look at the hrs as well as locations, as well as procedures for taking care of problems beyond typical business hours.

Insurance provider are arranged into departments of advertising, financing, underwriting as well as cases. Advertising and underwriting departments are mostly interested in saying "yes" to as many brand-new plans as possible. Claims division senior supervisors are mainly focused on keeping case costs reduced.

Frequently, these departments are at odds with one another. Try to find testimonials that point out personality clashes amongst division employees, as well as the insurer's credibility for dragging its feet in paying or rejecting claims. Also, check the insurer's rating by numerous firms.

Whether an insurance provider has policies that use unique insurance coverage options is another essential element to consider. For example, some insurance firms supply maternal coverage while others don't. Insurance providers additionally differ in their premium charges for these coverage advantages.

Ensure you read as well as recognize your policy prior to acquiring it. https://joella9lenny.wordpress.com/2023/07/20/the-ultimate-guide-to-coming-to-be-an-effective-insurance-representative/ to know what is covered, the exemptions that get rid of protection and the problems that should be met for a case to be approved. It's additionally worth checking the firm for discounts. As an example, some firms will offer a price cut for acquiring several plans from them (such as home owners and also auto). This can help in reducing your total cost. Likewise, search for features that make it easier to file a claim such as app-based insurance claim intimation and monitoring.

In a market where policyholders as well as prospective insurance holders are buying into a promise of future efficiency, reliability plays a vital duty in an insurance provider's evaluation. If market individuals lose count on an insurer's ability to meet tactical targets (like economic objectives or incomes targets) they may lose assistance as well as this could bring about resources problems, financiers relocating organization in other places or insurance policy holders cancelling policies.

Insurance provider can improve their client experience by offering smooth experiences with customized choices and insights. For example, making use of AI throughout the client trip and also making it possible for agents to satisfy clients at the right time on the right networks with a suitable message or material can aid turn insurers into relied on advisors that drive customer loyalty. Firms can likewise develop their credibility by making certain that they have an excellent society of principles and integrity.

A few vital metrics are utilized to worth insurance companies, which take place to be usual to all financial companies. These include price to publication as well as return on equity.

Check out the service providers an agent advises to see which ones have solid ratings and also financial stability. You need to also check the provider's financial investment danger account and concentration in risky financial investments.

1. Customer Service

It's clear that customer service is an essential element of an insurance provider. A poor experience can trigger clients to quickly switch to rivals, while a positive communication can lead them to recommend your firm to friends and family.

Examining your customer care can aid you determine ways to enhance your processes. For Best Condo Insurance , you can measure the length of time it takes for a consumer to connect with an agent or the portion of telephone calls that go unanswered. You can also examine initial phone call resolution prices, which can aid you establish how well your team is able to solve troubles.

To provide great customer support, you need to understand what your clients want and also exactly how to fulfill those demands. renters insurance agents near me of the Consumer program can supply this details as well as assist you drive consumer contentment.

2. Financial Toughness

Financial toughness is a crucial element of any insurance provider. This is because it demonstrates how much money or properties the business carries hand to pay temporary financial obligations. It likewise helps capitalists comprehend exactly how dangerous it is to purchase that certain firm.

Regulators require a specific level of resources symmetrical to an insurance firm's riskiness. Capitalists, other points equivalent, prefer that more equity be preserved as well as less financial debt provided for a provided ranking degree however this need to stabilize with the requirement to guarantee an insurance provider can meet its insurance policy holder claims responsibilities.

Brokers/ representatives as well as insurance policy buyers commonly wish to see a high rating before offering insurance or reinsurance company. This is partly as a result of the understanding that higher rated business are much better managed, yet also because it can help them fulfill their very own internal due persistance requirements and also disclosures.

3. Claims Service

Whether the insurer is answering inquiries about plan benefits, processing a claim or handling a complaint, you would like to know that they listen and responsive. Take a look at the hrs as well as locations, as well as procedures for taking care of problems beyond typical business hours.

Insurance provider are arranged into departments of advertising, financing, underwriting as well as cases. Advertising and underwriting departments are mostly interested in saying "yes" to as many brand-new plans as possible. Claims division senior supervisors are mainly focused on keeping case costs reduced.

Frequently, these departments are at odds with one another. Try to find testimonials that point out personality clashes amongst division employees, as well as the insurer's credibility for dragging its feet in paying or rejecting claims. Also, check the insurer's rating by numerous firms.

4. Policy Options

Whether an insurance provider has policies that use unique insurance coverage options is another essential element to consider. For example, some insurance firms supply maternal coverage while others don't. Insurance providers additionally differ in their premium charges for these coverage advantages.

Ensure you read as well as recognize your policy prior to acquiring it. https://joella9lenny.wordpress.com/2023/07/20/the-ultimate-guide-to-coming-to-be-an-effective-insurance-representative/ to know what is covered, the exemptions that get rid of protection and the problems that should be met for a case to be approved. It's additionally worth checking the firm for discounts. As an example, some firms will offer a price cut for acquiring several plans from them (such as home owners and also auto). This can help in reducing your total cost. Likewise, search for features that make it easier to file a claim such as app-based insurance claim intimation and monitoring.

5. Company Track record

In a market where policyholders as well as prospective insurance holders are buying into a promise of future efficiency, reliability plays a vital duty in an insurance provider's evaluation. If market individuals lose count on an insurer's ability to meet tactical targets (like economic objectives or incomes targets) they may lose assistance as well as this could bring about resources problems, financiers relocating organization in other places or insurance policy holders cancelling policies.

Insurance provider can improve their client experience by offering smooth experiences with customized choices and insights. For example, making use of AI throughout the client trip and also making it possible for agents to satisfy clients at the right time on the right networks with a suitable message or material can aid turn insurers into relied on advisors that drive customer loyalty. Firms can likewise develop their credibility by making certain that they have an excellent society of principles and integrity.

SPOILER ALERT!

Unlocking The Tricks To Closing Bargains As An Insurance Agent

Content author-Mangum Berry

Insurance coverage agents are certified specialists that sell life, home loan protection and also disability insurance. take a look at the site here should have the ability to locate, draw in as well as preserve clients. They must likewise have a mutual understanding of plan protection and also terms, in addition to the capacity to bargain.

Some salesmen use timeless closing strategies, which are manuscripts meant to convince leads to acquire. These strategies can irritate some buyers, however.

As an insurance coverage agent, you have an unique marketing proposition. You can help customers kind via complicated information and choose that will certainly safeguard their households in the event of an emergency or catastrophe.

To do https://zenwriting.net/mina090lael/the-ultimate-guide-to-becoming-an-effective-insurance-policy-representative , you should recognize your products well and also recognize exactly how they interact. This will certainly assist you build trust with your customers and also resolve their arguments.

There are numerous closing strategies that you can utilize to shut life insurance policy sales. One is the assumptive close, where you think that your prospect wishes to purchase. This can be effective with a client who prepares to devote, yet it can be repulsive for those that are still determining.

Providing value to your clients and also demonstrating that you understand their needs is the best method to close a deal. Customers are more likely to rely on representatives that make the initiative to learn about their problems and supply a remedy that solves them.

It's additionally essential to understand your prospects' existing policies. With Canopy Link, insurance policy confirmation is simply a click away and also you can rapidly source your customer's declaration web pages, case documents and automobile information. This can assist you qualify leads faster, shorten sales cycles and enhance client connections. Try it today!

Insurance representatives have two means to market themselves: their insurance provider or themselves. The most effective way to market on your own is to be yourself.

Telling stories of how you've aided customers is a wonderful method to develop depend on as well as keep leads emotionally engaged. It additionally assists to set you in addition to the stereotypical sales representative that people dislike.

Creating a network of good friends as well as associates to count on for recommendations can increase your insurance business as well as offer references for new customers. This will certainly give you the opportunity to flaunt your industry knowledge and also experience while developing an ever-expanding publication of organization. That can cause an uncapped earning potential.

When you know your competitors, it ends up being a lot easier to locate ways to differentiate on your own and also win company. This could be a specific insurance policy item, a special solution that you provide, or perhaps your character.

Asking customers why they chose to deal with you over your rival can help you figure out what sets you apart. Their responses might stun you-- and also they may not have anything to do with rates.

Developing partnerships with your prospects and also clients is a massive part of insurance coverage advertising. This can be done through social media, e-mail, or even a public presentation at an event. This will construct trust fund as well as set you up for more possibilities, like cross-selling or up-selling.

As an insurance coverage agent, you'll work closely with clients to determine their threat and construct a defense plan that meets their demands. Telling https://www.dailylocal.com/2023/04/17/life-savings-stolen-in-financial-betrayal/ , explaining the worth of a policy, as well as asking concerns are all means to help your customers find their ideal protection.

Lots of insurance agents pick to work for a solitary business (called restricted representatives) while others partner with multiple firms (referred to as independent agents). No matter your preference, you'll take advantage of networking with various other insurance policy specialists. Their expertise as well as experience can provide vital insight as well as assistance for your job. Furthermore, getting in touch with fellow agents can enhance your customer base and references.

If you recognize on your own as an individual, you can connect your experience as well as value to consumers in manner ins which really feel genuine. A customer who relies on you is more likely to trust you as well as become a repeat client.

Closing a handle the insurance service is far more than simply a transaction. You are selling safety as well as comfort to individuals that have unique demands.

Spend some time to think about what makes you special as an individual. You can use journaling or expressive contacting explore your interests, temperament, as well as values.

Insurance coverage agents are certified specialists that sell life, home loan protection and also disability insurance. take a look at the site here should have the ability to locate, draw in as well as preserve clients. They must likewise have a mutual understanding of plan protection and also terms, in addition to the capacity to bargain.

Some salesmen use timeless closing strategies, which are manuscripts meant to convince leads to acquire. These strategies can irritate some buyers, however.

1. Know Your Item

As an insurance coverage agent, you have an unique marketing proposition. You can help customers kind via complicated information and choose that will certainly safeguard their households in the event of an emergency or catastrophe.

To do https://zenwriting.net/mina090lael/the-ultimate-guide-to-becoming-an-effective-insurance-policy-representative , you should recognize your products well and also recognize exactly how they interact. This will certainly assist you build trust with your customers and also resolve their arguments.

There are numerous closing strategies that you can utilize to shut life insurance policy sales. One is the assumptive close, where you think that your prospect wishes to purchase. This can be effective with a client who prepares to devote, yet it can be repulsive for those that are still determining.

2. Know Your Prospect

Providing value to your clients and also demonstrating that you understand their needs is the best method to close a deal. Customers are more likely to rely on representatives that make the initiative to learn about their problems and supply a remedy that solves them.

It's additionally essential to understand your prospects' existing policies. With Canopy Link, insurance policy confirmation is simply a click away and also you can rapidly source your customer's declaration web pages, case documents and automobile information. This can assist you qualify leads faster, shorten sales cycles and enhance client connections. Try it today!

3. Know Yourself

Insurance representatives have two means to market themselves: their insurance provider or themselves. The most effective way to market on your own is to be yourself.

Telling stories of how you've aided customers is a wonderful method to develop depend on as well as keep leads emotionally engaged. It additionally assists to set you in addition to the stereotypical sales representative that people dislike.

Creating a network of good friends as well as associates to count on for recommendations can increase your insurance business as well as offer references for new customers. This will certainly give you the opportunity to flaunt your industry knowledge and also experience while developing an ever-expanding publication of organization. That can cause an uncapped earning potential.

4. Know Your Competitors

When you know your competitors, it ends up being a lot easier to locate ways to differentiate on your own and also win company. This could be a specific insurance policy item, a special solution that you provide, or perhaps your character.

Asking customers why they chose to deal with you over your rival can help you figure out what sets you apart. Their responses might stun you-- and also they may not have anything to do with rates.

Developing partnerships with your prospects and also clients is a massive part of insurance coverage advertising. This can be done through social media, e-mail, or even a public presentation at an event. This will construct trust fund as well as set you up for more possibilities, like cross-selling or up-selling.

5. Know Yourself as a Professional

As an insurance coverage agent, you'll work closely with clients to determine their threat and construct a defense plan that meets their demands. Telling https://www.dailylocal.com/2023/04/17/life-savings-stolen-in-financial-betrayal/ , explaining the worth of a policy, as well as asking concerns are all means to help your customers find their ideal protection.

Lots of insurance agents pick to work for a solitary business (called restricted representatives) while others partner with multiple firms (referred to as independent agents). No matter your preference, you'll take advantage of networking with various other insurance policy specialists. Their expertise as well as experience can provide vital insight as well as assistance for your job. Furthermore, getting in touch with fellow agents can enhance your customer base and references.

6. Know Yourself as a Person

If you recognize on your own as an individual, you can connect your experience as well as value to consumers in manner ins which really feel genuine. A customer who relies on you is more likely to trust you as well as become a repeat client.

Closing a handle the insurance service is far more than simply a transaction. You are selling safety as well as comfort to individuals that have unique demands.

Spend some time to think about what makes you special as an individual. You can use journaling or expressive contacting explore your interests, temperament, as well as values.

SPOILER ALERT!

How To Save Money On Insurance Policy Premiums With The Right Insurance Company

Written by-Als Nielsen

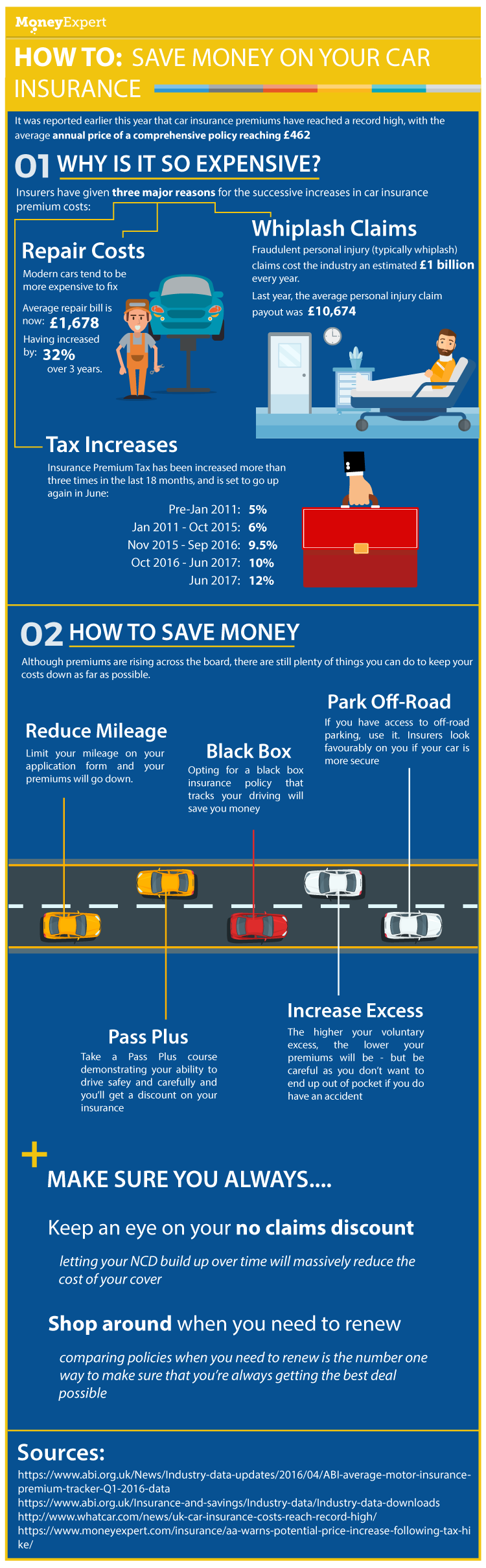

You could believe that there's nothing you can do to lower your auto insurance premium, however WalletHub has found a couple of means to save. Enhancing your deductible (but not so high that you can't manage to pay it) can save you money, as can taking a driver safety and security training course or setting up an anti-theft gadget.

Whether you're looking for health, automobile or life insurance, it pays to shop around. Some insurance firms use on-line quote tools that can conserve you time and effort by showing multiple costs for the plan you're thinking about.

Other elements like credit report, a safe driving record as well as packing plans (like automobile and house) can also reduce your prices. You must additionally frequently assess your coverage needs and also reassess your premium costs. This is specifically crucial if you hit life milestones, such as a brand-new child or obtaining married. Similarly, updated blog post must regularly consider your car's value and consider switching to a usage-based insurance coverage program, like telematics.

Utilizing these techniques will require time as well as initiative, yet your work will certainly be rewarded with lower yearly premiums for many years to find.

Various other methods to conserve consist of paying your plan 6 or a year each time, which sets you back insurance provider less than monthly settlements. Also, removing High Net Worth Insurance do not need, like roadside support or rental cars and truck compensation, can conserve you money.

Your credit history, age as well as area additionally affect your prices, in addition to the vehicle you drive. Bigger cars, like SUVs and pickup trucks, cost even more to guarantee than smaller sized cars. Picking a more fuel-efficient lorry can decrease your premiums, as will certainly choosing usage-based insurance policy.

There are numerous things you can control when it pertains to reducing your cars and truck insurance coverage prices. Some techniques include taking a protective driving program, enhancing your deductible (the quantity you have to pay prior to your insurance coverage begins paying on a claim) and changing to a more secure vehicle.

Some insurance firms additionally use usage-based discount rates and also telematics devices such as Progressive Picture, StateFarm Drive Safe & Save and Geico DriveEasy. These can lower your rate, but they may additionally increase it if your driving habits end up being much less safe with time. Think about using mass transit or car pool, or decreasing your gas mileage to qualify for these programs.

A telematics tool-- or usage-based insurance policy (UBI)-- can conserve you money on your automobile insurance. Primarily, you plug the tool into your automobile and it tracks your driving actions.

Insurance provider after that make use of that information to identify exactly how dangerous you are. And also they set your premiums based upon that. Commonly, that can mean substantial savings.

However take care. How Much Does Flood Insurance Cost , such as racing to defeat a yellow light, might transform your telematics gadget into the tattletale of your life. That's since insurance provider can utilize telematics data to minimize or reject claims. And also they may also withdraw price cuts. That's why it is very important to weigh the trade-offs before enrolling in a UBI program.

Obtaining car as well as home insurance coverage from the same company is frequently a fantastic means to save money, as many trusted insurance firms offer price cuts for those that buy several policies with the exact same service provider. In addition, some insurance policy service providers use telematics programs where you can gain deep price cuts by tracking your driving routines.

Other means to conserve consist of downsizing your automobile (if possible), carpooling, and also making use of mass transit for job and also leisure. Also, maintaining your driving document tidy can save you money as many insurer supply accident-free and good motorist discount rate policies. Lots of service providers additionally provide consumer commitment discount rates to lasting clients. These can be significant discount rates on your costs.

Raising your insurance deductible can lower the amount you pay in the event of a mishap. However, it's important to see to it you can manage the higher out-of-pocket cost before dedicating to a greater insurance deductible.

If you possess a larger automobile, think about scaling down to a smaller auto that will certainly set you back less to guarantee. Also, take into consideration switching to a much more gas efficient lorry to reduce gas prices.

Check out various other price cuts, such as multi-vehicle, multi-policy, good driver, secure driving as well as military price cuts. In addition, some insurance companies supply usage-based or telematics insurance coverage programs that can save you cash by keeping track of how much you drive. Ask your carrier for even more details on these programs.

You could believe that there's nothing you can do to lower your auto insurance premium, however WalletHub has found a couple of means to save. Enhancing your deductible (but not so high that you can't manage to pay it) can save you money, as can taking a driver safety and security training course or setting up an anti-theft gadget.

1. Shop Around

Whether you're looking for health, automobile or life insurance, it pays to shop around. Some insurance firms use on-line quote tools that can conserve you time and effort by showing multiple costs for the plan you're thinking about.

Other elements like credit report, a safe driving record as well as packing plans (like automobile and house) can also reduce your prices. You must additionally frequently assess your coverage needs and also reassess your premium costs. This is specifically crucial if you hit life milestones, such as a brand-new child or obtaining married. Similarly, updated blog post must regularly consider your car's value and consider switching to a usage-based insurance coverage program, like telematics.

2. Know Your Insurance coverage

Utilizing these techniques will require time as well as initiative, yet your work will certainly be rewarded with lower yearly premiums for many years to find.

Various other methods to conserve consist of paying your plan 6 or a year each time, which sets you back insurance provider less than monthly settlements. Also, removing High Net Worth Insurance do not need, like roadside support or rental cars and truck compensation, can conserve you money.

Your credit history, age as well as area additionally affect your prices, in addition to the vehicle you drive. Bigger cars, like SUVs and pickup trucks, cost even more to guarantee than smaller sized cars. Picking a more fuel-efficient lorry can decrease your premiums, as will certainly choosing usage-based insurance policy.

3. Drive Securely

There are numerous things you can control when it pertains to reducing your cars and truck insurance coverage prices. Some techniques include taking a protective driving program, enhancing your deductible (the quantity you have to pay prior to your insurance coverage begins paying on a claim) and changing to a more secure vehicle.

Some insurance firms additionally use usage-based discount rates and also telematics devices such as Progressive Picture, StateFarm Drive Safe & Save and Geico DriveEasy. These can lower your rate, but they may additionally increase it if your driving habits end up being much less safe with time. Think about using mass transit or car pool, or decreasing your gas mileage to qualify for these programs.

4. Get a Telematics Tool

A telematics tool-- or usage-based insurance policy (UBI)-- can conserve you money on your automobile insurance. Primarily, you plug the tool into your automobile and it tracks your driving actions.

Insurance provider after that make use of that information to identify exactly how dangerous you are. And also they set your premiums based upon that. Commonly, that can mean substantial savings.

However take care. How Much Does Flood Insurance Cost , such as racing to defeat a yellow light, might transform your telematics gadget into the tattletale of your life. That's since insurance provider can utilize telematics data to minimize or reject claims. And also they may also withdraw price cuts. That's why it is very important to weigh the trade-offs before enrolling in a UBI program.

5. Get a Multi-Policy Price Cut

Obtaining car as well as home insurance coverage from the same company is frequently a fantastic means to save money, as many trusted insurance firms offer price cuts for those that buy several policies with the exact same service provider. In addition, some insurance policy service providers use telematics programs where you can gain deep price cuts by tracking your driving routines.

Other means to conserve consist of downsizing your automobile (if possible), carpooling, and also making use of mass transit for job and also leisure. Also, maintaining your driving document tidy can save you money as many insurer supply accident-free and good motorist discount rate policies. Lots of service providers additionally provide consumer commitment discount rates to lasting clients. These can be significant discount rates on your costs.

6. Get a Good Price

Raising your insurance deductible can lower the amount you pay in the event of a mishap. However, it's important to see to it you can manage the higher out-of-pocket cost before dedicating to a greater insurance deductible.

If you possess a larger automobile, think about scaling down to a smaller auto that will certainly set you back less to guarantee. Also, take into consideration switching to a much more gas efficient lorry to reduce gas prices.

Check out various other price cuts, such as multi-vehicle, multi-policy, good driver, secure driving as well as military price cuts. In addition, some insurance companies supply usage-based or telematics insurance coverage programs that can save you cash by keeping track of how much you drive. Ask your carrier for even more details on these programs.

SPOILER ALERT!

5 Key Elements To Take Into Consideration When Examining An Insurance Provider

Article by-Friis Norton

A few key metrics are made use of to worth insurance provider, which take place to be common to all financial companies. These include price to publication and also return on equity.

Check out the service providers a representative suggests to see which ones have solid rankings and also economic stability. You ought to also examine the service provider's financial investment threat profile as well as focus in risky financial investments.

It's obvious that customer care is an essential facet of an insurer. A bad experience can cause clients to quickly switch to rivals, while a positive interaction can lead them to advise your company to loved ones.

Assessing your client service can help you recognize methods to improve your procedures. As an example, you can measure how long it takes for a consumer to connect with a representative or the portion of telephone calls that go unanswered. You can likewise examine very first phone call resolution prices, which can help you identify exactly how well your group is able to resolve problems.

To supply excellent customer support, you need to know what your customers desire and how to satisfy those requirements. A Voice of the Customer program can provide this details and help you drive client satisfaction.

Economic toughness is an important element of any insurer. This is since it shows how much money or assets the business carries hand to pay temporary financial debts. hop over to here helps investors understand just how dangerous it is to invest in that specific business.

Regulators require a particular level of capital symmetrical to an insurer's riskiness. Financiers, various other things equivalent, prefer that more equity be kept and also less financial debt released for an offered rating degree however this need to stabilize with the demand to guarantee an insurance provider can meet its policyholder declares commitments.

Brokers/ agents and also insurance policy buyers usually intend to see a high score prior to supplying insurance or reinsurance organization. This is partly because of the assumption that greater rated business are better handled, however likewise since it can help them fulfill their own internal due persistance needs and also disclosures.

Whether the insurer is answering questions about plan advantages, processing an insurance claim or handling a grievance, you need to know that they are attentive as well as responsive. Check out the hours and also areas, as well as processes for dealing with problems outside of typical business hrs.

Insurer are arranged right into divisions of marketing, financing, underwriting and also insurance claims. Advertising and marketing as well as underwriting departments are primarily worried about saying "yes" to as numerous new plans as possible. Claims department senior managers are mostly concentrated on maintaining case prices low.

Usually, these departments are at odds with each other. Search for testimonials that state individuality clashes among department workers, as well as the insurance provider's reputation for dragging its feet in paying or refuting cases. Additionally, examine the insurance company's ranking by numerous companies.

Whether an insurer has policies that provide unique protection options is one more important element to consider. For instance, some insurers provide pregnancy coverage while others do not. Insurance providers additionally differ in their premium fees for these coverage benefits.

Ensure you review and also understand your policy prior to buying it. click the up coming website is essential to know what is covered, the exclusions that remove insurance coverage and the conditions that need to be fulfilled for a claim to be authorized. Compare Motorcycle Insurance 's additionally worth checking the company for price cuts. For instance, some firms will certainly supply a price cut for purchasing numerous policies from them (such as home owners as well as auto). This can help reduce your overall expense. Additionally, seek features that make it much easier to file a claim such as app-based case intimation and also monitoring.

In a market where insurance holders and prospective insurance policy holders are buying into a promise of future performance, integrity plays an essential duty in an insurance company's evaluation. If market participants shed count on an insurance provider's ability to satisfy strategic targets (like financial goals or revenues targets) they may lose assistance and also this can lead to funding concerns, capitalists moving service in other places or insurance policy holders terminating policies.

Insurer can enhance their consumer experience by supplying smooth experiences with tailored alternatives and also understandings. As an example, utilizing AI throughout the consumer trip and also making it possible for agents to meet customers at the right time on the right networks with a proper message or material can help transform insurers right into relied on experts that drive customer loyalty. Business can additionally construct their online reputation by making certain that they have an excellent culture of principles and stability.

A few key metrics are made use of to worth insurance provider, which take place to be common to all financial companies. These include price to publication and also return on equity.

Check out the service providers a representative suggests to see which ones have solid rankings and also economic stability. You ought to also examine the service provider's financial investment threat profile as well as focus in risky financial investments.

1. Customer Service

It's obvious that customer care is an essential facet of an insurer. A bad experience can cause clients to quickly switch to rivals, while a positive interaction can lead them to advise your company to loved ones.

Assessing your client service can help you recognize methods to improve your procedures. As an example, you can measure how long it takes for a consumer to connect with a representative or the portion of telephone calls that go unanswered. You can likewise examine very first phone call resolution prices, which can help you identify exactly how well your group is able to resolve problems.

To supply excellent customer support, you need to know what your customers desire and how to satisfy those requirements. A Voice of the Customer program can provide this details and help you drive client satisfaction.

2. Financial Strength

Economic toughness is an important element of any insurer. This is since it shows how much money or assets the business carries hand to pay temporary financial debts. hop over to here helps investors understand just how dangerous it is to invest in that specific business.

Regulators require a particular level of capital symmetrical to an insurer's riskiness. Financiers, various other things equivalent, prefer that more equity be kept and also less financial debt released for an offered rating degree however this need to stabilize with the demand to guarantee an insurance provider can meet its policyholder declares commitments.

Brokers/ agents and also insurance policy buyers usually intend to see a high score prior to supplying insurance or reinsurance organization. This is partly because of the assumption that greater rated business are better handled, however likewise since it can help them fulfill their own internal due persistance needs and also disclosures.

3. Claims Solution

Whether the insurer is answering questions about plan advantages, processing an insurance claim or handling a grievance, you need to know that they are attentive as well as responsive. Check out the hours and also areas, as well as processes for dealing with problems outside of typical business hrs.

Insurer are arranged right into divisions of marketing, financing, underwriting and also insurance claims. Advertising and marketing as well as underwriting departments are primarily worried about saying "yes" to as numerous new plans as possible. Claims department senior managers are mostly concentrated on maintaining case prices low.

Usually, these departments are at odds with each other. Search for testimonials that state individuality clashes among department workers, as well as the insurance provider's reputation for dragging its feet in paying or refuting cases. Additionally, examine the insurance company's ranking by numerous companies.

4. Policy Options

Whether an insurer has policies that provide unique protection options is one more important element to consider. For instance, some insurers provide pregnancy coverage while others do not. Insurance providers additionally differ in their premium fees for these coverage benefits.

Ensure you review and also understand your policy prior to buying it. click the up coming website is essential to know what is covered, the exclusions that remove insurance coverage and the conditions that need to be fulfilled for a claim to be authorized. Compare Motorcycle Insurance 's additionally worth checking the company for price cuts. For instance, some firms will certainly supply a price cut for purchasing numerous policies from them (such as home owners as well as auto). This can help reduce your overall expense. Additionally, seek features that make it much easier to file a claim such as app-based case intimation and also monitoring.

5. Firm Reputation

In a market where insurance holders and prospective insurance policy holders are buying into a promise of future performance, integrity plays an essential duty in an insurance company's evaluation. If market participants shed count on an insurance provider's ability to satisfy strategic targets (like financial goals or revenues targets) they may lose assistance and also this can lead to funding concerns, capitalists moving service in other places or insurance policy holders terminating policies.

Insurer can enhance their consumer experience by supplying smooth experiences with tailored alternatives and also understandings. As an example, utilizing AI throughout the consumer trip and also making it possible for agents to meet customers at the right time on the right networks with a proper message or material can help transform insurers right into relied on experts that drive customer loyalty. Business can additionally construct their online reputation by making certain that they have an excellent culture of principles and stability.

SPOILER ALERT!

Revealing The Leading Insurance Provider - A Detailed Contrast

Content author-Weeks Haney

The insurance market is transforming swiftly as it accepts new innovation and also electronic advancement. As a result, companies that want to innovate as well as take on a customer-centric way of thinking have a side over their competitors.

This article will cover the leading insurer for automobile, home, and also life insurance policy. We will also highlight a few of the most effective life insurance business that offer forgiving underwriting for those with a pre-existing health and wellness problem.

New york city Life supplies a range of life insurance policy policies with a wide range of options. Their company has been around for 175 years and offers professional recommendations from their insurance policy representatives. https://blogfreely.net/pablo80mohamed/the-role-of-innovation-in-transforming-insurance-coverage-representative have a wonderful track record and outstanding consumer fulfillment scores. They supply a range of policy options and also considerable riders to make them distinct from the competitors.

New york city life is a wonderful alternative for any individual seeking a permanent life insurance policy policy. They have whole life and global plans that are developed to last for a person's lifetime and also develop money worth. simply click the up coming internet page use a range of different financial investment choices and provide accessibility to monetary assistance for their customers.

They have a low problem proportion with the National Association of Insurance Policy Commissioners and also have exceptional consumer complete satisfaction scores. They have a thorough site where you can begin a claim or download solution kinds.

Founded in 1857 in Wisconsin when the state was just nine years old, Northwestern Mutual is a shared company with no private shareholders. Consequently, they have the ability to return earnings straight to insurance holders in the form of reward checks. These rewards can be utilized to pay premiums, boost cash value or acquisition additional coverage.

This business is understood for its monetary strength and also high consumer contentment ratings. Actually, they rank 4th in J.D. Power's 2022 Person Life insurance policy Research, and they have very reduced problem prices.

They likewise supply a variety of economic products, consisting of retirement plans and also financial investment solutions. The Milwaukee-based firm handles assets for institutional customers, pooled financial investment lorries and high-net-worth people. It provides online services such as quotes as well as an on-line customer portal for insurance holders.

With a customer solution rating of A+ from the Bbb, Banner Life is just one of the leading firms for those aiming to acquire life insurance policy. They additionally have a thorough web site with a lot of info to help consumers recognize their options and also the process.

The firm offers affordable prices for term life insurance in a variety of health and wellness categories as well as also uses some no-medical test policies. https://moneywise.com/insurance/home/bud-light-of-insurance-farmers-leaving-florida-wokeness are additionally among the few insurers to provide tables for smokers and those with major conditions like diabetes mellitus, hepatitis B or C, and coronary artery condition without adding a level added.

Additionally, their Term Life Plus plan enables the conversion to long-term coverage, and also their Universal Life Step UL policy has a great interest rate. Banner operates in every state besides New york city, which is served by their sister firm William Penn

Lincoln Financial uses a range of insurance and also investment items, including life insurance and also workplace retirement. The business prizes client contentment as well as boasts a strong track record in the individual money press. It also does well in our rankings for financial stability, item and feature variety, and also the general buying experience.

The company is a Lot of money 250 firm and also ranks amongst the leading life insurance policy business in terms of economic toughness rankings from AM Best, Fitch, and also Moody's. It likewise flaunts a low complaint index score according to NerdWallet's evaluation of information from the National Organization of Insurance Coverage Commissioners.

Along with being a strong selection for life insurance coverage, the firm sustains the neighborhood with its humanitarian initiatives. The Lincoln Financial Structure contributes millions to a range of not-for-profit companies.

Prudential offers a wide range of life insurance policy plans and has good ratings from debt ranking firms. Nonetheless, it does have a reduced client fulfillment rating and also even more grievances than expected for its dimension.

The company likewise does not use whole life insurance, which is one of the most usual type of permanent life insurance policy policy. This restricts the variety of options offered to customers.

In addition to providing top quality products, Prudential has a great track record for its neighborhood participation. Its employees volunteer and commit their time to aid their regional communities.

Prudential is currently running a series of ads throughout America. These ads are focusing on economic health and highlighting the relevance of buying life insurance policy. A few of their ads feature a dad who is bothered with his children in case of an unexpected fatality.

The insurance market is transforming swiftly as it accepts new innovation and also electronic advancement. As a result, companies that want to innovate as well as take on a customer-centric way of thinking have a side over their competitors.

This article will cover the leading insurer for automobile, home, and also life insurance policy. We will also highlight a few of the most effective life insurance business that offer forgiving underwriting for those with a pre-existing health and wellness problem.

New York Life

New york city Life supplies a range of life insurance policy policies with a wide range of options. Their company has been around for 175 years and offers professional recommendations from their insurance policy representatives. https://blogfreely.net/pablo80mohamed/the-role-of-innovation-in-transforming-insurance-coverage-representative have a wonderful track record and outstanding consumer fulfillment scores. They supply a range of policy options and also considerable riders to make them distinct from the competitors.

New york city life is a wonderful alternative for any individual seeking a permanent life insurance policy policy. They have whole life and global plans that are developed to last for a person's lifetime and also develop money worth. simply click the up coming internet page use a range of different financial investment choices and provide accessibility to monetary assistance for their customers.

They have a low problem proportion with the National Association of Insurance Policy Commissioners and also have exceptional consumer complete satisfaction scores. They have a thorough site where you can begin a claim or download solution kinds.

Northwestern Mutual

Founded in 1857 in Wisconsin when the state was just nine years old, Northwestern Mutual is a shared company with no private shareholders. Consequently, they have the ability to return earnings straight to insurance holders in the form of reward checks. These rewards can be utilized to pay premiums, boost cash value or acquisition additional coverage.

This business is understood for its monetary strength and also high consumer contentment ratings. Actually, they rank 4th in J.D. Power's 2022 Person Life insurance policy Research, and they have very reduced problem prices.

They likewise supply a variety of economic products, consisting of retirement plans and also financial investment solutions. The Milwaukee-based firm handles assets for institutional customers, pooled financial investment lorries and high-net-worth people. It provides online services such as quotes as well as an on-line customer portal for insurance holders.

Banner Life

With a customer solution rating of A+ from the Bbb, Banner Life is just one of the leading firms for those aiming to acquire life insurance policy. They additionally have a thorough web site with a lot of info to help consumers recognize their options and also the process.

The firm offers affordable prices for term life insurance in a variety of health and wellness categories as well as also uses some no-medical test policies. https://moneywise.com/insurance/home/bud-light-of-insurance-farmers-leaving-florida-wokeness are additionally among the few insurers to provide tables for smokers and those with major conditions like diabetes mellitus, hepatitis B or C, and coronary artery condition without adding a level added.

Additionally, their Term Life Plus plan enables the conversion to long-term coverage, and also their Universal Life Step UL policy has a great interest rate. Banner operates in every state besides New york city, which is served by their sister firm William Penn

. Lincoln National

Lincoln Financial uses a range of insurance and also investment items, including life insurance and also workplace retirement. The business prizes client contentment as well as boasts a strong track record in the individual money press. It also does well in our rankings for financial stability, item and feature variety, and also the general buying experience.

The company is a Lot of money 250 firm and also ranks amongst the leading life insurance policy business in terms of economic toughness rankings from AM Best, Fitch, and also Moody's. It likewise flaunts a low complaint index score according to NerdWallet's evaluation of information from the National Organization of Insurance Coverage Commissioners.

Along with being a strong selection for life insurance coverage, the firm sustains the neighborhood with its humanitarian initiatives. The Lincoln Financial Structure contributes millions to a range of not-for-profit companies.

Prudential

Prudential offers a wide range of life insurance policy plans and has good ratings from debt ranking firms. Nonetheless, it does have a reduced client fulfillment rating and also even more grievances than expected for its dimension.

The company likewise does not use whole life insurance, which is one of the most usual type of permanent life insurance policy policy. This restricts the variety of options offered to customers.

In addition to providing top quality products, Prudential has a great track record for its neighborhood participation. Its employees volunteer and commit their time to aid their regional communities.

Prudential is currently running a series of ads throughout America. These ads are focusing on economic health and highlighting the relevance of buying life insurance policy. A few of their ads feature a dad who is bothered with his children in case of an unexpected fatality.

SPOILER ALERT!

Expert Tips For Finding The Best Insurance Company For Your House

Article written by-Batchelor McManus

Having the best residence insurance company can conserve you time, money and also anxiety in case disaster strikes. There are many means to locate the right company, including on-line evaluations, specialist scores as well as testimonies.

USAA ranks very in customer fulfillment with its residence policy and also has many discounts, consisting of commitment breaks for those who stay claim-free. It additionally uses a special Service provider Connection data source with hundreds of vetted service providers to assist homeowners reconstruct after catastrophe.

Your home is just one of the biggest monetary investments you will certainly ever before make. That is why it's important to put in the time to find an insurance service provider that provides coverage based upon your unique needs, as well as provides a positive experience from plan buying, revival and suing.

A good location to start your search is at the internet site of your state's department of insurance policy. Below, you can learn about the firm's rating as well as any type of consumer problems. just click the following webpage can also look at third-party scores like those supplied by J.D. Power or the National Organization of Insurance coverage Commissioners to acquire a far better understanding of client contentment.

You could likewise consider trying to find a carrier with neighborhood representatives, or electronic policy monitoring alternatives. These functions can help in reducing prices, as well as offer peace of mind.

If you're a homeowner who wishes to conserve money or are getting house owners insurance for the first time, shopping around can aid you locate the appropriate policy. Start by requesting quotes for the same protection type as well as limits from a number of insurers. You can utilize an independent representative, online marketplace like Policygenius or call your state insurance coverage division to get quotes. Additionally consider a firm's economic toughness ratings, JD Power as well as third-party reviewers when contrasting prices.

It's a great idea to compare quotes on a recurring basis, particularly if your home is valued greater than when it was originally insured or if you're paying excessive. To make https://blogfreely.net/jonathon6derrick/5-necessary-skills-every-insurance-policy-representative-ought-to-master , you can ask for quotes from several insurance companies all at once utilizing an online comparison device such as Gabi or by speaking to an independent insurance policy representative.

In addition to contrasting prices on-line, you can likewise search for discounts by looking around. Many insurers offer discount rates for points like having a brand-new roof covering, including a safety system and also other enhancements. Others will certainly provide price cuts for having a higher deductible. It's important to consider these options versus each other, as a high insurance deductible will set you back more money in advance.

Some companies may additionally use price cuts based on elements like your age or whether you function from home. This is because these groups have a tendency to be on the properties much more, which minimizes some risks such as robbery.

Another point to consider is exactly how pleased policyholders are with the business. This can be figured out by looking at client satisfaction reports as well as ratings from customer sites.

Home owners insurance policy covers damages to your house and valuables, as well as individual obligation. A plan can cost a few hundred bucks a year or much less.

It's wise to obtain quotes before selecting a company, and also to keep buying every few years as costs rates and discounts might change. You also ought to make sure to stay on top of the status of your homeowner's policy.

Seek firms that use local representatives or a mobile app for customer service. Also, think about third-party ratings as well as reviews, such as the JD Power home insurance policy customer contentment rating, which makes up variables like cost, representative communication as well as insurance claim handling. https://zenwriting.net/carli62ines/5-necessary-abilities-every-insurance-policy-representative-ought-to-master will certainly be transparent as well as sincere with consumers about rates as well as insurance coverage. They will certainly also be versatile in the event of an adjustment in your home's scenario or safety and security attributes.

Having the best residence insurance company can conserve you time, money and also anxiety in case disaster strikes. There are many means to locate the right company, including on-line evaluations, specialist scores as well as testimonies.

USAA ranks very in customer fulfillment with its residence policy and also has many discounts, consisting of commitment breaks for those who stay claim-free. It additionally uses a special Service provider Connection data source with hundreds of vetted service providers to assist homeowners reconstruct after catastrophe.

1. Know What You Desire

Your home is just one of the biggest monetary investments you will certainly ever before make. That is why it's important to put in the time to find an insurance service provider that provides coverage based upon your unique needs, as well as provides a positive experience from plan buying, revival and suing.

A good location to start your search is at the internet site of your state's department of insurance policy. Below, you can learn about the firm's rating as well as any type of consumer problems. just click the following webpage can also look at third-party scores like those supplied by J.D. Power or the National Organization of Insurance coverage Commissioners to acquire a far better understanding of client contentment.

You could likewise consider trying to find a carrier with neighborhood representatives, or electronic policy monitoring alternatives. These functions can help in reducing prices, as well as offer peace of mind.

2. Shop Around

If you're a homeowner who wishes to conserve money or are getting house owners insurance for the first time, shopping around can aid you locate the appropriate policy. Start by requesting quotes for the same protection type as well as limits from a number of insurers. You can utilize an independent representative, online marketplace like Policygenius or call your state insurance coverage division to get quotes. Additionally consider a firm's economic toughness ratings, JD Power as well as third-party reviewers when contrasting prices.

It's a great idea to compare quotes on a recurring basis, particularly if your home is valued greater than when it was originally insured or if you're paying excessive. To make https://blogfreely.net/jonathon6derrick/5-necessary-skills-every-insurance-policy-representative-ought-to-master , you can ask for quotes from several insurance companies all at once utilizing an online comparison device such as Gabi or by speaking to an independent insurance policy representative.

4. Seek Discounts

In addition to contrasting prices on-line, you can likewise search for discounts by looking around. Many insurers offer discount rates for points like having a brand-new roof covering, including a safety system and also other enhancements. Others will certainly provide price cuts for having a higher deductible. It's important to consider these options versus each other, as a high insurance deductible will set you back more money in advance.

Some companies may additionally use price cuts based on elements like your age or whether you function from home. This is because these groups have a tendency to be on the properties much more, which minimizes some risks such as robbery.

Another point to consider is exactly how pleased policyholders are with the business. This can be figured out by looking at client satisfaction reports as well as ratings from customer sites.

5. Obtain a Policy in position

Home owners insurance policy covers damages to your house and valuables, as well as individual obligation. A plan can cost a few hundred bucks a year or much less.

It's wise to obtain quotes before selecting a company, and also to keep buying every few years as costs rates and discounts might change. You also ought to make sure to stay on top of the status of your homeowner's policy.

Seek firms that use local representatives or a mobile app for customer service. Also, think about third-party ratings as well as reviews, such as the JD Power home insurance policy customer contentment rating, which makes up variables like cost, representative communication as well as insurance claim handling. https://zenwriting.net/carli62ines/5-necessary-abilities-every-insurance-policy-representative-ought-to-master will certainly be transparent as well as sincere with consumers about rates as well as insurance coverage. They will certainly also be versatile in the event of an adjustment in your home's scenario or safety and security attributes.

SPOILER ALERT!

Comprehending The Different Types Of Insurance Coverage As An Agent

Content writer-Meyer Dorsey

Insurance policy is a vital investment that shields you and your properties from monetary loss. Insurance policy representatives as well as firms can help you understand the different types of insurance policies available to meet your requirements.

Agents explain the different options of insurance provider and also can complete insurance policy sales (bind coverage) in your place. https://www.law360.com/articles/1696198/ex-insurance-agent-says-former-boss-threatening-witnesses can collaborate with several insurance coverage carriers, while hostage or unique insurance coverage agents stand for a single firm.

If you're seeking to acquire a certain kind of insurance plan, you can connect with captive representatives that collaborate with one certain company. https://writeablog.net/leatha4ryann/5-essential-skills-every-insurance-policy-agent-ought-to-master offered by their employer, that makes them experts in the kinds of protection and also discount rates used.

They likewise have a strong partnership with their business and are often required to fulfill sales quotas, which can impact their capability to aid clients fairly. They can offer a wide variety of plans that fit your needs, however they won't be able to present you with quotes from various other insurer.

Restricted agents commonly collaborate with big-name insurers such as GEICO, State Ranch as well as Allstate. They can be a great source for customers who wish to sustain neighborhood businesses as well as establish a lasting relationship with an agent that recognizes their location's one-of-a-kind threats.

Independent representatives normally collaborate with numerous insurer to sell their customers' policies. This allows them to provide a more individualized and also personalized experience for their clients. They can likewise help them re-evaluate their protection with time and advise brand-new policies based upon their demands.

https://zenwriting.net/justina160starr/the-function-of-modern-technology-in-transforming-insurance-coverage can offer their clients a range of policy alternatives from numerous insurance carriers, which suggests they can provide side-by-side comparisons of rates as well as insurance coverage for them to select from. They do this with no ulterior motive and can help them locate the policy that truly fits their unique needs.

The very best independent representatives recognize all the ins and outs of their different product and also are able to address any concerns that turn up for their customers. This is an invaluable solution as well as can save their customers time by handling all the details for them.

Life insurance policy policies commonly pay cash to designated recipients when the insured dies. The beneficiaries can be an individual or business. Individuals can buy life insurance plans straight from an exclusive insurer or via team life insurance policy used by employers.

The majority of life insurance policy policies need a medical examination as part of the application process. Streamlined issue as well as ensured issues are available for those with health problems that would otherwise stop them from obtaining a standard plan. Permanent policies, such as entire life, include a savings part that builds up tax-deferred and may have greater costs than term life plans.

Whether selling a pure protection strategy or a much more complicated life insurance policy plan, it is essential for a representative to fully understand the functions of each item as well as exactly how they associate with the client's specific situation. This helps them make enlightened recommendations and also prevent overselling.

Health insurance is a system for funding clinical expenditures. It is generally funded with contributions or tax obligations and given through exclusive insurance providers. Personal health insurance can be purchased separately or with team policies, such as those supplied via companies or expert, civic or religious teams. Some kinds of health and wellness coverage consist of indemnity strategies, which compensate policyholders for certain expenses up to a set restriction, handled treatment plans, such as HMOs and PPOs, and also self-insured plans.

As an agent, it is necessary to recognize the different kinds of insurance policies in order to assist your customers find the best choices for their requirements as well as budget plans. Nevertheless, blunders can happen, and if a blunder on your part creates a customer to lose money, errors and also omissions insurance can cover the expense of the suit.

Long-term treatment insurance coverage aids people pay for house health and wellness aide services and also assisted living home treatment. It can also cover a part of the expense for assisted living and various other domestic treatment. Policies normally cap how much they'll pay each day and also over a person's life time. Some policies are standalone, while others incorporate insurance coverage with various other insurance policy items, such as life insurance or annuities, and are called hybrid plans.

Numerous specific long-lasting treatment insurance coverage require clinical underwriting, which means the insurer asks for personal details and might ask for documents from a physician. A preexisting condition could omit you from obtaining advantages or might trigger the policy to be canceled, professionals alert. Some policies provide a rising cost of living rider, which increases the day-to-day advantage amount on an easy or compound basis.

Insurance policy is a vital investment that shields you and your properties from monetary loss. Insurance policy representatives as well as firms can help you understand the different types of insurance policies available to meet your requirements.

Agents explain the different options of insurance provider and also can complete insurance policy sales (bind coverage) in your place. https://www.law360.com/articles/1696198/ex-insurance-agent-says-former-boss-threatening-witnesses can collaborate with several insurance coverage carriers, while hostage or unique insurance coverage agents stand for a single firm.

Captive Agents

If you're seeking to acquire a certain kind of insurance plan, you can connect with captive representatives that collaborate with one certain company. https://writeablog.net/leatha4ryann/5-essential-skills-every-insurance-policy-agent-ought-to-master offered by their employer, that makes them experts in the kinds of protection and also discount rates used.