SPOILER ALERT!

Fantastic Tips For Successfully Managing Insurance Coverage

Article by-Fraser Mohamed

Insurance: car insurance, life insurance, home insurance, health insurance, and the list goes on. Everyone needs to invest in many types of insurance throughout their lives, but how can you be sure you are picking the right kind from the right agent? This article offers some useful tips and tricks for choosing the right kind of insurance and the right insurance company.

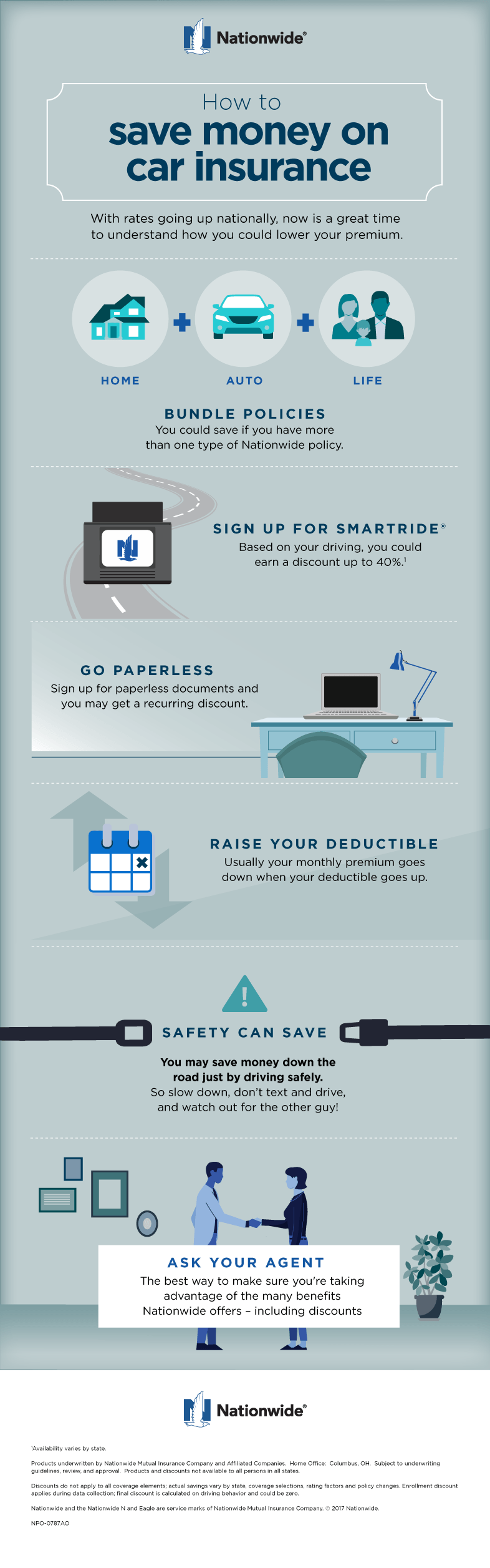

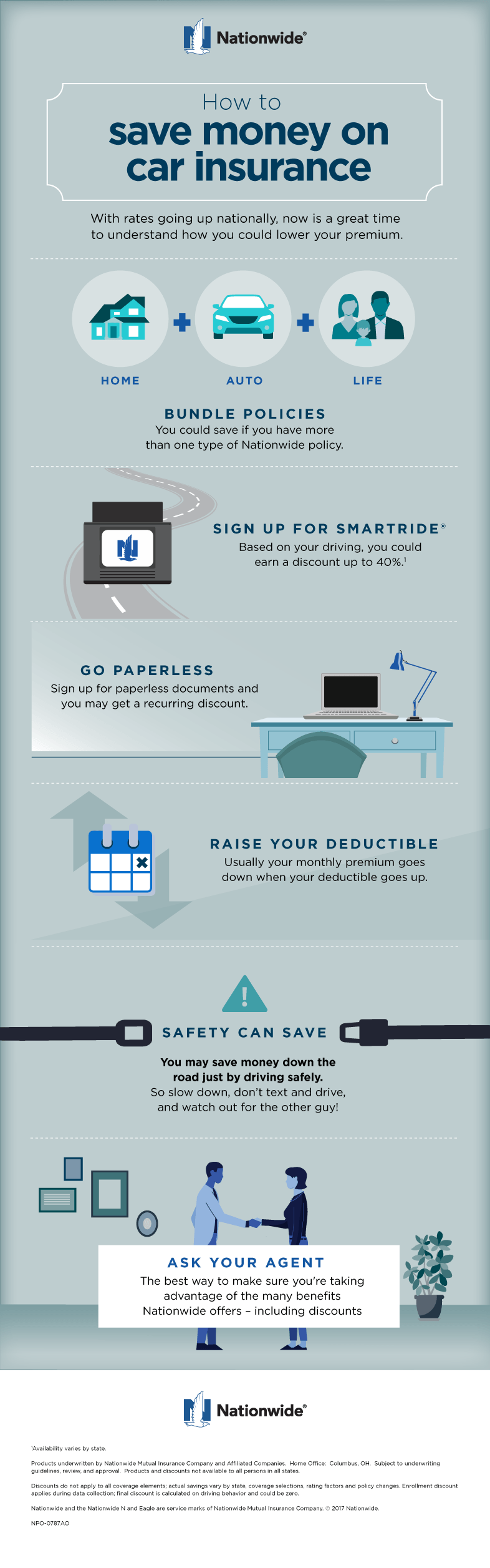

By having all of your insurance policies with one company, you can often receive many different discounts that would otherwise not be available to you. Spend some time asking your representative about how much they could save you if you switched all of your other policies to their company.

If you are looking to save money on insurance, research into group rates in associations you may already be a part of. Organizations like AAA, AARP, and university alumni associations sometimes offer great insurance rates for their members. This can help you both save money and utilize the benefits of the organization that you are a part of.

To save money on your insurance, you should look for low rates but also for low deductibles. A deductible is the minimum amount that you have to pay your insurance to cover the damages. An insurance might offer a very low price but charge you too much for your deductibles.

You should find an insurance company that can handle all of your insurance needs. If you bundle multiple types of insurance with a single carrier, the savings can be quite large. If you change car insurer to chase a discount, that discount may be nullified by the increase in your homeowner's insurance rate.

Insurance coverage is a very important thing for those who own property, valuable items, or have motor vehicles. It ensures that if any damage is done to your property or the people using your property is covered under the insurance company. This can mean a lot when you need money to cover your losses.

Insurance will save one's car, another driver's car, items in one's apartment, cover the bills for a sick pet, reimburse one for a trip that got cancelled because of bad weather, or pay medical bills.

Do your research. Read online reviews and look at ratings for the insurance companies you are interested in using. Check out the Better Business Bureau site to see how they rank. Find out if others are having good or bad experiences with them. Let these influence your decision on which to choose.

When looking for insurance, there are many different types to choose from. There is medical, dental, home, car, vision and life. Before just going out and buying any insurance, make sure you know what it is that you need to insure, then you can go and get quotes and find what is the best fit for you.

If you've tied the knot, add your spouse to your insurance policy. Just like a teenager is charged more because they are considered a risk, being married is a sign of stability and you will generally see your rate go down. Make sure and check with both of your insurance companies to see who will offer the better deal.

Check with the company that you get your other insurances from, like rental insurance and life, to see if they offer a policy for car insurance. Invention will offer you a discount for purchasing multiple policies from them. It may not be the cheapest option so you still need to get quotes from elsewhere to be sure.

Do not try to overstate the value of any of your property while you are in the process of filing an insurance claim. https://s3.ca-central-1.amazonaws.com/financial-advisor-alberta-22/infinite-banking.html have been trained to spot the value of certain things and it will make them red flag your claim if you are claiming that something has more worth than it does.

When looking for insurance, there are many different types to choose from. There is medical, dental, home, car, vision and life. Before just going out and buying any insurance, make sure you know what it is that you need to insure, then you can go and get quotes and find what is the best fit for you.

To have a better understanding of your insurance costs, learn about the various things that effect your premiums. Everything from your age to your gender to your zip code can play a role in your premium rates. Learning more about your premiums may give you the knowledge you need to lower your insurance rates.

If you are applying for car insurance and you are a student it would greatly help you if you have good grades in school. There are many auto insurance carriers that will provide discounts on premiums for students that have grades that are above a particular GPA, since it shows them that you are trustworthy.

You will protect all of your valuables from disaster or things you do not foresee. It's important to have insurance to protect you in the case of an unexpected situation, which damages your items.

You should be focused on removing your vehicle from any towing yard it may find itself within, as fast as possible after an accident. Storing a towed car is typically paid for on a daily basis, and your car insurer will rarely cover the expense if you let these fees pile up.

When you are trying to consider how much insurance to buy it is best to purchase as much as you can comfortably afford. This is a good idea because you would not like it if you end up having losses that exceed your coverage and the difference in the premium was just a few dollars more.

Before you commit to an insurance carrier, you may first wish to consult your state's insurance department. Many state departments keep a great deal of information about all carriers. Your state insurance department is a valuable resource to check on rates, coverage, or any complaints that are outstanding when you are deciding on which carrier to choose.

If you submit an insurance claim and it is denied, always take the time to appeal the denial. At times insurance carriers initially deny a claim and then later are willing to reconsider the claim. Unless the circumstances of your claim are specifically excluded on your policy, appealing a denial can be well worth the time and effort.

In summary, there is a lot of information on the Internet to sort through and determine what is legitimate. Hopefully you not only found this resource useful but you learned something new about insurance. With the tips that we provided and some self motivation, you should not be far off from being an expert.

Insurance: car insurance, life insurance, home insurance, health insurance, and the list goes on. Everyone needs to invest in many types of insurance throughout their lives, but how can you be sure you are picking the right kind from the right agent? This article offers some useful tips and tricks for choosing the right kind of insurance and the right insurance company.

By having all of your insurance policies with one company, you can often receive many different discounts that would otherwise not be available to you. Spend some time asking your representative about how much they could save you if you switched all of your other policies to their company.

If you are looking to save money on insurance, research into group rates in associations you may already be a part of. Organizations like AAA, AARP, and university alumni associations sometimes offer great insurance rates for their members. This can help you both save money and utilize the benefits of the organization that you are a part of.

To save money on your insurance, you should look for low rates but also for low deductibles. A deductible is the minimum amount that you have to pay your insurance to cover the damages. An insurance might offer a very low price but charge you too much for your deductibles.

You should find an insurance company that can handle all of your insurance needs. If you bundle multiple types of insurance with a single carrier, the savings can be quite large. If you change car insurer to chase a discount, that discount may be nullified by the increase in your homeowner's insurance rate.

Insurance coverage is a very important thing for those who own property, valuable items, or have motor vehicles. It ensures that if any damage is done to your property or the people using your property is covered under the insurance company. This can mean a lot when you need money to cover your losses.

Insurance will save one's car, another driver's car, items in one's apartment, cover the bills for a sick pet, reimburse one for a trip that got cancelled because of bad weather, or pay medical bills.

Do your research. Read online reviews and look at ratings for the insurance companies you are interested in using. Check out the Better Business Bureau site to see how they rank. Find out if others are having good or bad experiences with them. Let these influence your decision on which to choose.

When looking for insurance, there are many different types to choose from. There is medical, dental, home, car, vision and life. Before just going out and buying any insurance, make sure you know what it is that you need to insure, then you can go and get quotes and find what is the best fit for you.

If you've tied the knot, add your spouse to your insurance policy. Just like a teenager is charged more because they are considered a risk, being married is a sign of stability and you will generally see your rate go down. Make sure and check with both of your insurance companies to see who will offer the better deal.

Check with the company that you get your other insurances from, like rental insurance and life, to see if they offer a policy for car insurance. Invention will offer you a discount for purchasing multiple policies from them. It may not be the cheapest option so you still need to get quotes from elsewhere to be sure.

Do not try to overstate the value of any of your property while you are in the process of filing an insurance claim. https://s3.ca-central-1.amazonaws.com/financial-advisor-alberta-22/infinite-banking.html have been trained to spot the value of certain things and it will make them red flag your claim if you are claiming that something has more worth than it does.

When looking for insurance, there are many different types to choose from. There is medical, dental, home, car, vision and life. Before just going out and buying any insurance, make sure you know what it is that you need to insure, then you can go and get quotes and find what is the best fit for you.

To have a better understanding of your insurance costs, learn about the various things that effect your premiums. Everything from your age to your gender to your zip code can play a role in your premium rates. Learning more about your premiums may give you the knowledge you need to lower your insurance rates.

If you are applying for car insurance and you are a student it would greatly help you if you have good grades in school. There are many auto insurance carriers that will provide discounts on premiums for students that have grades that are above a particular GPA, since it shows them that you are trustworthy.

You will protect all of your valuables from disaster or things you do not foresee. It's important to have insurance to protect you in the case of an unexpected situation, which damages your items.

You should be focused on removing your vehicle from any towing yard it may find itself within, as fast as possible after an accident. Storing a towed car is typically paid for on a daily basis, and your car insurer will rarely cover the expense if you let these fees pile up.

When you are trying to consider how much insurance to buy it is best to purchase as much as you can comfortably afford. This is a good idea because you would not like it if you end up having losses that exceed your coverage and the difference in the premium was just a few dollars more.

Before you commit to an insurance carrier, you may first wish to consult your state's insurance department. Many state departments keep a great deal of information about all carriers. Your state insurance department is a valuable resource to check on rates, coverage, or any complaints that are outstanding when you are deciding on which carrier to choose.

If you submit an insurance claim and it is denied, always take the time to appeal the denial. At times insurance carriers initially deny a claim and then later are willing to reconsider the claim. Unless the circumstances of your claim are specifically excluded on your policy, appealing a denial can be well worth the time and effort.

In summary, there is a lot of information on the Internet to sort through and determine what is legitimate. Hopefully you not only found this resource useful but you learned something new about insurance. With the tips that we provided and some self motivation, you should not be far off from being an expert.